UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. __)

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for use of the Commission only as permitted by Rule 14a-6(e)(2) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Material |

| ☐ | Solicitation Material under §240.14a-12 |

| SOBR SAFE, INC. |

| (Name of Registrant as Specified in Its Charter) |

________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a‑6(i)(1) and 0‑11. |

SOBR Safe, Inc.

NOTICE OF 2024 ANNUAL MEETING OF

STOCKHOLDERS & PROXY STATEMENT

Improving behavioral outcomes & savings lives

6400 S. Fiddlers Green Circle | Suite 1400 | Greenwood Village, CO 80111 | Nasdaq: SOBR

SOBR Safe, Inc.

6400 South Fiddlers Green Circle, Suite 1400

Greenwood Village, Colorado 80111

1.844.SOBRSAFE (762.7723)

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS AND IMPORTANT NOTICE REGARDING

THE AVAILABILITY OF PROXY MATERIALS

To Be Held on June 3, 2024

Dear Valued Stockholders of SOBR Safe, Inc.:

It is our pleasure to invite you to the 2024 Annual Meeting of Stockholders of SOBR Safe, Inc. (the “Company”) to be held virtually on Monday, June 3, 2024 at 1:00 P.M., Mountain Time, via webcast at: www.virtualshareholdermeeting.com/SOBR2024 (the “Annual Meeting”). At the Annual Meeting, the Company will submit the following four (4) proposals to its stockholders for approval:

|

| 1. | To elect five (5) directors to our Board of Directors, each to serve until our next annual meeting of stockholders, or until his or her respective successor is duly elected and qualified; |

|

|

|

|

|

| 2. | To approve, by a nonbinding “say-on-pay” advisory vote, the compensation of our named executive officers; |

|

|

|

|

|

| 3. | To approve, by a nonbinding “say-when-on-pay” advisory vote, the frequency of future advisory votes on the compensation of our named executive officers; and |

|

|

|

|

|

| 4. | To grant the Board of Directors discretion (if necessary to maintain a listing of the Company’s common stock on the Nasdaq Capital Market) to amend the Company’s certificate of incorporation to implement a reverse stock split of the outstanding shares of common stock in a range from one-for-two (1:2) up to one-for-one hundred fifty (1:150), or anywhere between, as may be determined by the Board of Directors on or before December 31, 2024 (the “Reverse Stock Split”). |

Additionally, any other matters may be submitted to the stockholders as may properly come before the Annual Meeting and any adjournment or postponement thereof.

The discussion of the proposals set forth above is intended only as a summary and is qualified in its entirety by the information contained in the accompanying Proxy Statement. The accompanying Proxy Statement is being furnished to our stockholders for informational purposes only, pursuant to Section 14(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations prescribed thereunder. The Board will be soliciting your proxy in connection with the matters discussed above. Stockholders who wish to vote on the proposals accordingly must either virtually attend the Annual Meeting or otherwise designate a proxy to attend the Annual Meeting and vote on their behalf.

The Company is using the “Full Set Delivery” method of providing proxy materials to all stockholders of record. Because we have elected to utilize the “Full Set Delivery” option, we are delivering to all stockholders of record paper copies of the Company’s Proxy Statement, Annual Report on Form 10-K, and form of Proxy, as well as providing access to those proxy materials on a publicly accessible website. The Company’s Proxy Statement, Annual Report on Form 10-K, form of Proxy, and the other Annual Meeting materials are available on the internet at: www.proxyvote.com.

Other detailed information about us and our operations, including our audited financial statements, are included in our Annual Report on Form 10-K (the “Annual Report”) and can be accessed here: http:// www.sobrsafe.com.

The Board of Directors has fixed the close of business on April 24, 2024 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and at any adjournment or postponement thereof. Only holders of record of our common stock on the Record Date will be entitled to notice of and to vote at the Annual Meeting, and any postponements or adjournments thereof. There were no shares of Preferred Stock outstanding on the Record Date. Stockholders of record virtually present at the Annual Meeting or who have submitted a valid proxy via the internet, by telephone, or by mail may vote at the Annual Meeting.

Your vote is very important to us. Whether or not you expect to attend the Annual Meeting, please submit your proxy in advance online, by telephone, or by mail to ensure that your vote will be represented at the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that record holder.

Please refer to the “Voting Instructions” section of the Proxy Statement for instructions on submitting your vote. Voting promptly will save us additional expense in further soliciting proxies and will ensure that your shares are represented at the Annual Meeting.

|

| By Order of the Board of Directors, | |

|

|

| |

|

| /s/ David Gandini | |

|

| David Gandini | |

|

| Chairman of the Board and CEO | |

|

| Greenwood Village, Colorado | |

|

| May 13, 2024 |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON JUNE 3, 2024: THE ANNUAL REPORT AND PROXY STATEMENT ARE AVAILABLE ONLINE AT: www.proxyvote.com.

SOBR SAFE, Inc.

6400 South Fiddlers Green Circle, Suite 1400

Greenwood Village, Colorado 80111

1.844.SOBRSAFE (762.7723)

PROXY STATEMENT

May 13, 2024

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of SOBR Safe, Inc., a Delaware corporation (the “Company”), for use at the Company’s 2024 Annual Meeting of Stockholders to be held virtually on Monday, June 3, 2024 at 1:00 P.M., Mountain Time, via webcast at: www.virtualshareholdermeeting.com/SOBR2024 (the “Annual Meeting”) and any adjournment or postponement thereof.

Delivery of Proxy Materials and Annual Report

This Proxy Statement (including the Notice of Annual Meeting of Stockholders) is first being made available to stockholders beginning on or about May 17, 2024. The Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, including financial statements (“Annual Report”), was filed with the Securities and Exchange Commission (the “SEC”) on April 1, 2024.

We are using the “Full Set Delivery” method of providing proxy materials to stockholders. Because we have elected to utilize the “Full Set Delivery” option, we are delivering to all stockholders of record paper copies of the Company’s Proxy Statement, Annual Report on Form 10-K, and form of Proxy, as well as providing access to those proxy materials on a publicly accessible website. The Company’s Proxy Statement, Annual Report on Form 10-K, form of Proxy, and the other Annual Meeting materials are available on the internet at: www.proxyvote.com.

Instructions for Attending Annual Meeting

Only stockholders of record at the close of business on April 24, 2024 will be entitled to vote at the Annual Meeting. To participate in and vote at the Annual Meeting, you must virtually attend the Annual Meeting via webcast at: www.virtualshareholdermeeting.com/SOBR2024, or submit your proxy in advance. The Annual Meeting will begin promptly at 1:00 P.M., Mountain Time, on June 3, 2024. Attendees of the Annual Meeting will be provided the opportunity to submit questions, subject to the Annual Meeting Rules of Conduct. The Chairman of the Annual Meeting has broad authority to conduct the meeting in an orderly manner.

| 1 |

Voting Securities

The specific proposals to be considered and acted upon at our Annual Meeting are each described in this Proxy Statement. Only holders of our common stock as of the close of business on April 24, 2024 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting. On the Record Date, there were 20,007,465 shares of common stock issued, and 19,995,136 shares outstanding. Each holder of common stock is entitled to one vote for each share of common stock held as of the Record Date. As a result, the holders of common stock are entitled to an aggregate of 19,995,136 votes. There were no shares of Preferred Stock outstanding on the Record Date.

Cumulative voting shall not be allowed in the election of directors or any of the proposals being submitted to the stockholders at the Annual Meeting.

Quorum

In order for any business to be conducted at the Annual Meeting, a quorum must be present. The presence at the Annual Meeting, either virtually or by proxy, of holders of one-third of the outstanding shares of the Company entitled to vote (6,665,046 shares) will constitute a quorum for the transaction of business. If you submit a properly executed proxy, regardless of whether you abstain from voting on one or more matters, your shares will be counted as present at the Annual Meeting for the purpose of establishing a quorum. Abstentions and broker non-votes will be counted for the purpose of establishing a quorum. If a quorum is not present at the scheduled time of the Annual Meeting, the Chairman of the Annual Meeting may adjourn the Annual Meeting until a quorum is present. The time and place of the adjourned Annual Meeting will be announced at the time the adjournment is taken, and no other notice will be given. An adjournment will have no effect on the business that may be conducted at the Annual Meeting.

Matters to be Voted Upon

There are four (4) matters scheduled for a vote:

|

| 1. | To elect five (5) directors to our Board of Directors, each to serve until our next annual meeting of stockholders, or until their respective successor is duly elected and qualified; |

|

|

|

|

|

| 2. | To approve, by a nonbinding “say-on-pay” advisory vote, the compensation of our named executive officers; |

|

|

|

|

|

| 3. | To approve, by a nonbinding “say-when-on-pay” advisory vote, the frequency of future advisory votes on the compensation of our named executive officers; and |

|

|

|

|

|

| 4. | To grant the Board of Directors discretion (if necessary to maintain a listing of the Company’s common stock on the Nasdaq Capital Market) to amend the Company’s certificate of incorporation to implement a reverse stock split of the outstanding shares of common stock in a range from one-for-two (1:2) up to one-for-one hundred fifty (1:150), or anywhere between as may be determined by the Board of Directors on or before December 31, 2024 (the “Reverse Stock Split”). |

| 2 |

At this time, the Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

Required Vote for Approval

1. Election of Directors. Directors are elected by a plurality vote. This means that the five director nominees who receive the greatest number of affirmative votes cast at the Annual Meeting by the shares present, either virtually or represented by proxy, and entitled to vote, will be elected. As to the election of the director nominees, you may vote “For” the election of all or any one of the nominees, or “Withhold” your authority to vote for all or any one of the nominees being proposed. Cumulative voting shall not be allowed in the election of directors. Withholding authority to vote your shares with respect to one or more director nominees will have no effect on the election of those nominees. Broker non-votes will have no effect on the election of the nominees.

2. Say-on-Pay. The “say-on-pay” advisory vote on the compensation of our named executive officers will be approved by the affirmative vote of a majority of the shares present or represented by proxy and entitled to vote at the Annual Meeting. However, while we intend to carefully consider the voting results of this proposal, the final vote is advisory in nature and therefore not binding on the Company. Our Board of Directors values the opinions of all of our stockholders and will consider the outcome when making future decisions with respect to executive compensation. As to the “say-on-pay” advisory vote on the compensation of our named executive officers, you may vote “For” or “Against” or “Abstain” from such proposal. Abstentions will have the same effect as votes against this proposal. Broker non-votes will have no effect on this proposal.

3. Say-when-on-Pay. The “say-when-on-pay” advisory vote on the frequency of future advisory votes on the compensation of our named executive officers is advisory in nature and therefore not binding on the Company. The option that receives the most votes will be deemed the preference of the stockholders, and our Board of Directors will consider the outcome when making future decisions with respect to the frequency of advisory votes on executive compensation. As to the “say-when-on-pay” advisory vote on the frequency of future advisory votes on the compensation of our named executive officers, you may vote “Every Three Years,” “Every Two Years,” “Every One Year,” or “Abstain” from such proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

4. Reverse Stock Split. The proposal to grant the Board of Directors discretion (if necessary to maintain a listing of the Company’s common stock on the Nasdaq Capital Market) to amend the Company’s certificate of incorporation to implement a reverse stock split of the outstanding shares of common stock in a range from one-for-two (1:2) up to one-for-one hundred fifty (1:150), or anywhere between as may be determined by the Board of Directors on or before December 31, 2024 (the “Reverse Stock Split”) will be approved if the votes cast “For” the proposal exceed the votes cast “Against” the proposal. As to the approval of the Reverse Stock Split, you may vote “For” or “Against” or “Abstain” from such proposal. Abstentions and broker non-votes will have no effect on this proposal.

| 3 |

Voting Instructions

Stockholders of Record: Shares Registered in Your Name

If on April 24, 2024, your shares were registered directly in your name with the Company’s transfer agent, EQ Shareowner Services, then you are a stockholder of record. As a stockholder of record, you may vote virtually at the Annual Meeting or by proxy in advance of the Annual Meeting by visiting www.proxyvote.com, completing and returning the proxy card by mail, or calling 1-800-690-6903.

Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy via the internet to ensure your vote is counted. You may still virtually attend the Annual Meeting and vote at the Annual Meeting even if you have already voted by proxy.

|

| ● | To vote at the Annual Meeting, attend the Annual Meeting virtually and you will be afforded an opportunity to vote via the internet. |

|

|

|

|

|

| ● | To submit a proxy online in advance of the Annual Meeting, visit www.proxyvote.com. |

|

|

|

|

|

| ● | To submit a proxy via telephone in advance of the Annual Meeting, call 1-800-690-6903. |

|

|

|

|

|

| ● | To submit a proxy by mail, complete, sign and date the printed proxy card enclosed with the proxy materials, and return it promptly in the postage-paid envelope provided. If we receive your signed proxy card before the Annual Meeting, we will vote your shares as you direct. |

If your proxy is properly returned to the Company, the shares represented thereby will be voted at the Annual Meeting in accordance with the instructions specified thereon.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If on April 24, 2024, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. Simply complete the steps included in the voting instruction form to ensure that your vote is counted.

You are also invited to attend the Annual Meeting. To vote at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials or contact your broker or bank to request a proxy form.

| 4 |

Abstentions and Broker Non-Votes

An abstention represents a stockholder’s affirmative choice to decline to vote on a proposal. If a stockholder indicates on its proxy card that it wishes to abstain from voting its shares, or if a broker, bank or other nominee holding its customers’ shares of record causes abstentions to be recorded for shares, these shares will be considered present and entitled to vote. As a result, abstentions will be counted for purposes of determining the presence or absence of a quorum and will also count as votes against a proposal in cases where approval of the proposal requires the affirmative vote of a majority of the shares present and entitled to vote at the Annual Meeting. Abstentions will have no effect where approval of the proposal requires the shares voted “For” to exceed the shares voted “Against.”

A broker non-vote occurs when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the broker, bank or other nominee does not have discretionary voting power with respect to such proposal and has not received voting instructions from the beneficial owner of the shares. Broker non-votes will be counted for purposes of calculating whether a quorum is present at the Annual Meeting but will not otherwise affect the outcome of the vote on any proposal at the Annual Meeting.

Failure to Vote

If you are a stockholder of record and do not vote by proxy in advance of the meeting, or vote at the Annual Meeting, your shares will not be voted.

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the particular proposal is considered to be a routine matter under applicable rules. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine” under applicable rules but not with respect to “non-routine” matters. Under applicable stock exchange rules and interpretations, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. Unless you provide voting instructions to your broker, your broker or nominee may NOT vote your shares on the election of directors (Proposal 1), the “say-on-pay” advisory vote on executive compensation (Proposal 2), or the “say-when-on-pay” advisory vote on the frequency of advisory votes on executive compensation (Proposal 3), but may vote your shares on the Reverse Stock Split (Proposal No. 4).

Failure to Specify Vote

If you are a stockholder of record and return your proxy without specifying how the shares represented thereby are to be voted, the proxy will be voted (i) FOR the election of the five director nominees named in this Proxy Statement, (ii) FOR the approval of the compensation paid to the Company’s Named Executive Officers, (iii) to conduct an advisory vote on executive compensation Every Three Years, (iv) FOR the Reverse Stock Split, and (v) at the discretion of the proxy holders on any other matter that may properly come before the Annual Meeting or any adjournment or postponement thereof.

Revocation of Proxies; Changing Vote

You may revoke or change your proxy at any time before the Annual Meeting by (i) filing, with our Corporate Secretary at our executive offices, located at 6400 South Fiddlers Green Circle, Suite 1400, Greenwood Village, Colorado 80111 a notice of revocation of proxy; (ii) delivering a properly executed, later-dated proxy prior to the Annual Meeting; or (iii) voting at the Annual Meeting. Attendance at the Annual Meeting by itself will not revoke a proxy. Shares can be voted at the Annual Meeting only if the holder is present or represented by proxy. If you are a stockholder whose shares are not registered in your own name, you will need additional documentation from your broker or record holder to vote at the Annual Meeting.

| 5 |

No Appraisal Rights

The stockholders of the Company have no dissenter’s or appraisal rights in connection with any of the proposals described herein.

Solicitation

Solicitation in connection with the Annual Meeting is made by the Company. We will bear the entire cost of solicitation, including the preparation, assembly, printing, mailing, and posting of this Proxy Statement, the Annual Report, the form of Proxy and any additional solicitation materials furnished to stockholders. Copies of any solicitation materials will be furnished to brokerage houses, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. In addition, we may reimburse such persons for their costs in forwarding the solicitation materials to such beneficial owners. The original solicitation of proxies may be supplemented by a solicitation by telephone, e-mail, or other means by our directors, officers or employees. No additional compensation will be paid to these individuals for any such services. Except as described above, we do not presently intend to solicit proxies other than by e-mail, telephone, and mail.

Forward Looking Statements

This Proxy Statement may contain certain “forward-looking” statements, as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), in connection with the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties, as well as assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially and adversely from those expressed or implied by such forward-looking statements.

Such forward-looking statements include statements about our expectations, beliefs or intentions regarding actions contemplated by this Proxy Statement, our potential business, financial condition, results of operations, strategies or prospects. You can identify forward-looking statements by the fact that these statements do not relate strictly to historical or current matters. Rather, forward-looking statements relate to anticipated or expected events, activities, trends or results as of the date they are made and are often identified by the use of words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” or “will,” and similar expressions or variations. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements. Many factors could cause our actual activities or results to differ materially from the activities and results anticipated in forward-looking statements. These factors include those described under the caption “Risk Factors” included in our other filings with the Securities and Exchange Commission (“SEC”), including the disclosures set forth in Item 1A of our Form 10-K for the year ended December 31, 2023. Furthermore, such forward-looking statements speak only as of the date of this Proxy Statement. We undertake no obligation to update any forward-looking statements to reflect events or circumstances occurring after the date of such statements.

| 6 |

MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Bylaws provide that the number of directors that constitute the entire Board of Directors (the “Board”) shall be fixed from time to time by resolution adopted by a majority of the entire Board. Our Board currently consists of five directors, each of whom has been nominated by our Nominating and Corporate Governance Committee for election at the Annual Meeting. The five director nominees for election at the Annual Meeting are:

|

| · | Steven Beabout |

|

| · | Noreen Butler |

|

| · | Ford Fay |

|

| · | David Gandini |

|

| · | Sandy Shoemaker |

Each director nominee, if elected at the Annual Meeting, will hold office for a one-year term until the next annual meeting of stockholders or until his or her successor is duly elected, unless prior thereto the director resigns, or the director’s office becomes vacant by reason of death or other cause. If any such person is unable or unwilling to serve as a director nominee at the date of the Annual Meeting or any postponement or adjournment thereof, the proxies may be voted for a substitute director nominee, designated by the proxy holders and subject to the rules for stockholder director nominations set forth in the Bylaws, or by the present Board to fill such vacancy. The Board has no reason to believe that any of such director nominees will be unwilling or unable to serve if elected as a director.

Vote Required

Directors will be elected by a plurality of the votes cast at the Annual Meeting. The five nominees receiving the highest number of affirmative votes will be elected. You may vote “For” the election of the nominees, or “Withhold” for the nominees being proposed. Withholding authority to vote your shares with respect to one or more director nominees will have no effect on the election of those nominees. Broker non-votes will have no effect on the election of the nominees. Cumulative voting shall not be allowed in the election of directors.

Board of Directors Recommendation

THE BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION OF STEVEN BEABOUT, NOREEN BUTLER, FORD FAY, DAVID GANDINI, AND SANDY SHOEMAKER.

DIRECTORS, DIRECTOR NOMINEES AND EXECUTIVE OFFICERS

The following table sets forth the names and ages of our directors, director nominees, and executive officers as of March 29, 2024, and the principal offices and positions with the Company held by each person. The directors serve one-year terms until their successors are elected. The executive officers of the Company are elected annually by the Board of Directors. The executive officers serve terms of one year or until their death, resignation, or removal by the Board of Directors. Unless described below, there are no family relationships among any of the directors and officers.

| Name |

| Age |

| Position(s) |

|

|

|

|

|

|

| David Gandini |

| 66 |

| Chief Executive Officer, Secretary, Chairman of the Board, and Director |

|

|

|

|

|

|

| Christopher Whitaker |

| 52 |

| Chief Financial Officer and Treasurer |

|

|

|

|

|

|

| Ford Fay |

| 63 |

| Independent Director (Chairperson of Nominating and Corporate Governance Committee) |

|

|

|

|

|

|

| J. Steven Beabout |

| 70 |

| Independent Director (Chairperson of Compensation Committee) |

|

|

|

|

|

|

| Noreen Butler |

| 50 |

| Independent Director |

|

|

|

|

|

|

| Sandy Shoemaker |

| 55 |

| Independent Director (Chairperson of Audit Committee) |

David Gandini has served as our Chief Executive Officer since October 18, 2021, and on our Board of Directors since November 2019. Mr. Gandini has been consulting regarding our business development since December 2018. Since September 2018, Mr. Gandini has also been a managing partner with First Capital Advisory Services, where he was responsible for capital creation, new business acquisition, business strategy and development, and partnership revenue generation. From 2014 to August 2017, Mr. Gandini was President of Alchemy Plastics, Inc., Englewood Colorado where he was responsible for US manufacturing, sales, and strategic partnerships. From 2001 until 2014, when the company was acquired, Mr. Gandini served as the President of IPS Denver, a bank card personalization and packaging entity where he managed the company and market transformations to become a leader in the U.S. secured gift market space with revenues of $46M. Prior to his engagement at IPS, Mr. Gandini was the Chief Operations Officer at First World Communications, a major U.S. Internet and Data Center provider, and participated in its successful IPO in 2000 raising over $200M. Previously, Mr. Gandini founded Pace Network Services providing carrier SS7 signaling to U.S. long distance providers and facilitated a successful exit to ICG Communications on the heels of co-founding Detroit based Digital Signal in the fiber optic long haul market sector where me managed a successful exit to SP Telecom. Mr. Gandini graduated from Michigan State University with a degree in Telecommunications.

| 7 |

Christopher Whitaker has served as our Chief Financial Officer since January 2024. Prior to his appointment as Chief Financial Officer, Mr. Whitaker served as the Company’s Vice President of Finance and Accounting since February 2022. Mr. Whitaker has held various executive finance positions with large public multi-national corporations and small entrepreneurial companies throughout a progressive 30-year career that began with KPMG LLP in Denver, Colorado. Prior to joining the Company, Mr. Whitaker served as President - Americas and Vice President of Finance and Administration from February 2020 through June 2021 for North and South American operations with public, multinational corporation Elixinol, Inc. Through advancing executive roles, his responsibilities at Elixinol, Inc. included management of all financial and accounting operations, and leading marketing, sales, consumer product goods development, information technology, and human resource functions. Prior to Elixinol, Inc., Mr. Whitaker served as the Managing Director of AEGIS Financial Consulting, LLC, from January 2015 through January 2020, leading a team of consultants in providing fractional CFO and financial consulting services to a wide variety of businesses in the public and private sectors. Mr. Whitaker has been a Certified Public Accountant since 2014. He earned his Bachelor of Science degree in Accounting from the Metropolitan State University of Denver in December 1999.

Ford B. Fay has served as a member of our Board of Directors since June 2020 and serves as the Chairperson of the Nominating and Corporate Governance Committee of our Board of Directors. Mr. Fay is currently the Director at Crown Castle International Corp., a large fiber-based telecommunications company. In this position Mr. Fay manages all aspects of Network Access Life Cycle for the company. He has held this position since 2020. From 2017 to 2020, Mr. Fay was a principal with Eagle Bay Advisors, LLC, a telecommunications consulting firm. In this position, Mr. Fay assisted clients with cost and efficiency improvements in Access Management across the life cycle spectrum of Access. From 2015 to 2017, Mr. Fay was the Vice President, Access Management for Zayo Communications. In this position Mr. Fay created and managed most aspects of offnet costs, such as, vendor selection, contracting, procurement, quoting, operationalization, vendor management, offnet ordering, offnet grooming and optimization. In this position, Mr. Fay also planned and executed the network integrations of the $1.4B acquisition of Electric Lightwave and the $350M acquisition of Canadian-based Allstream. Mr. Fay received his Bachelor of Science in Operations Research & Industrial Engineering from Cornell University, and his Master of Business Administration from University of Rochester, Simon School of Business.

J. Steven Beabout has served as a member of our Board of Directors since August 2020 and serves as the Chairperson of the Compensation Committee and Lead Independent Director of our Board of Directors. Since 2018, Mr. Beabout has been consulting with various startup companies and involved in real estate investing. From 2016-2018, Mr. Beabout was General Counsel of Tectonic, LLC, a SaaS company specializing in big data analytics and customer relationship management (CRM). In this position, Mr. Beabout was in charge of Tectonic’s legal department and negotiated deals with large companies like Coca-Cola, Anhueser-Busch and Wyndham Hotels. From 1996 to 2015, Mr. Beabout was General Counsel and a member of the strategic management team (executive vice-president) of Starz, a company listed on NASDAQ that competes with HBO and Netflix. During his time there, Mr. Beabout assisted with other key management personnel to grow the business from a start-up with $100M in losses to a multi-billiondollar public company. As part of strategic management team, Mr. Beabout was involved in the company’s strategic business decisions and as General Counsel he was responsible for all legal aspects of business, including, but not limited to, negotiation of billion dollar plus contacts with major studios (Universal, Disney and Sony), and distributors (Comcast, Time- Warner, DIRECTV, DISH Networks, Netflix, etc.), human resources and related matters, general corporate matters, post-IPO public board matters, and reviewing filings with the Securities and Exchange Commission.

Noreen Butler has served as a member of our Board of Directors since October 2022. Ms. Butler’s experience combines over 12 years in senior management and recruitment, following a 7-year career in business development. She is currently the Founder and Chief Executive Officer of RubiCorp Technologies, Inc., a private ridesharing company focused on safely transporting children ages 7+ for busy families and those in need of safe, trusted transportation. Previously, Ms. Butler had been involved in several companies in real estate, biotechnology and the technology industry, holding positions including Senior Advisor, Director of Business Development and Chief Executive Officer. From 2015 through June 2016, Ms. Butler was the Director of Business Development for Frozen Egg Bank Network, a division of global fertility company Donor Egg Bank. From 2016 to 2018, she was a Senior Advisor for Cresa, an international commercial real estate company. Ms. Butler has an undergraduate degree in Communications from Pine Manor College.

Sandy Shoemaker has served as a member of our Board of Directors since December 2021 and serves as Chairperson of the audit committee of our Board of Directors. Ms. Shoemaker retired from public accounting in June 2021 to focus on consulting with small-medium sized companies. She was a partner in the audit service area of EKS&H/Plante Moran and was involved in public accounting since 1990, serving publicly traded and privately held companies. She led the EKS&H SEC practice for several years. Ms. Shoemaker’s experience includes initial and secondary public offerings, reverse mergers, annual and quarterly audits/reviews of public companies, responses to SEC comment letters, assisting with implementation of new accounting pronouncements, business acquisitions, stock-based compensation, and internal controls. Ms. Shoemaker has provided services to companies in the various industries such as bio-tech, franchising, distribution, manufacturing, medical-device, restaurants and real estate industries. She also has extensive experience in working with employee-owned companies. Ms. Shoemaker has numerous professional affiliations including, but not limited to, American Institute of Certified Public Accountants (AICPA), the Colorado Society of Certified Public Accountants (CSCPA), and the National Center for Employee Ownership (NCEO). Ms. Shoemaker received her B.S. in Accounting, graduating cum laude, from Southwest Missouri State University.

| 8 |

BOARD DIVERSITY

Our five directors come from diverse backgrounds. We comply with Nasdaq Listing Rule 5605(f), which requires Nasdaq-listed smaller reporting companies to have at least two diverse directors.

The table below provides certain highlights of the composition of our Board members and nominees as of May 13, 2024 and March 14, 2023. Each of the categories listed in the table below has the meaning as it is used in Nasdaq Listing Rule 5605(f).

| Board Diversity Matrix | ||||||||||||||||||||||||||||||||

|

|

| (As of May 13, 2024) |

|

| (As of March 14, 2023) |

| ||||||||||||||||||||||||||

| Total Number of Directors |

| 5 |

|

| 5 |

| ||||||||||||||||||||||||||

|

|

| Female |

|

| Male |

|

| Non-Binary |

|

| Did Not Disclose Gender |

|

| Female |

|

| Male |

|

| Non-Binary |

|

| Did Not Disclose Gender |

| ||||||||

| Gender Identity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

| Directors |

|

| 2 |

|

|

| 3 |

|

|

| — |

|

|

| — |

|

|

| 2 |

|

|

| 3 |

|

|

| — |

|

|

| — |

|

| Demographic Background |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| African American or Black |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

| Alaskan Native or Native American |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

| Asian |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

| Hispanic or Latinx |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

| Native Hawaiian or Pacific Islander |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

| White |

|

| 2 |

|

|

| 3 |

|

|

| — |

|

|

| — |

|

|

| 2 |

|

|

| 3 |

|

|

| — |

|

|

| — |

|

| Two or More Races or Ethnicities |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

| LGBTQ+ |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

| Did Not Disclose Demographic Background |

|

| 5* |

|

|

|

|

|

| 5* |

| |||||||||||||||||||||

* Did not disclose with respect to LGBTQ+ background.

| 9 |

DIRECTOR NOMINATIONS

The Board nominates directors for election at each annual meeting of stockholders, appoints new directors to fill vacancies when they arise, and has the responsibility to identify, evaluate and recruit qualified director candidates to the Board for such nomination or appointment.

The Nominating and Corporate Governance Committee identifies director nominees by first considering those current members of the Board who are willing to continue service. Current members of the Board with skills and experience that are relevant to our business and who are willing to continue service are considered for re-election, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. After being nominated by the Nominating Committee, director nominees are selected by a majority of the members of the Board. Although the Company does not have a formal diversity policy, in considering the suitability of director nominees, both the Nominating Committee and the Board consider such factors as they deem appropriate to develop a Board that is diverse in nature and comprised of experienced and seasoned advisors. Factors considered by the Nominating and Corporate Governance Committee and the Board include judgment, knowledge, skill, diversity, integrity, experience with businesses and other organizations of comparable size, including experience in law enforcement, the use of force product industry, intellectual property, business, corporate governance, marketing, finance, administration or public service, the relevance of a candidate’s experience to our needs and experience of other Board members, experience with accounting rules and practices, the desire to balance the considerable benefit of continuity with the periodic injection of the fresh perspective provided by new members, and the extent to which a candidate would be a desirable addition to the Board and any committees of the Board.

A stockholder who wishes to suggest a prospective director nominee for the Board may notify the Corporate Secretary of the Company in writing with any supporting material the stockholder considers appropriate. Director nominees suggested by stockholders are considered in the same way as director nominees recommended by other sources.

Term of Office

Our directors hold office until the next annual meeting or until their successors have been elected and qualified, or until they resign or are removed. Our Board of Directors appoints our officers, and our officers hold office until their successors are chosen and qualify, or until their resignation or their removal.

Family Relationships

There are no family relationships among our directors and executive officers.

INVOLVEMENT IN CERTAIN LEGAL PROCEEDINGS

Our directors and executive officers have not been involved in any of the following events during the past ten years:

| 1.

| Other than the involuntary bankruptcy proceeding mentioned herein, no bankruptcy petition has been filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; | |

| 2. | Any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); | |

| 3.

| Being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; | |

| 4.

| Being found by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; |

| 10 |

| 5.

| Being the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of: (i) any federal or state securities or commodities law or regulation; or (ii) any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or (iii) any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

|

| 6.

| Being the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Securities Exchange Act of 1934), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

On January 22, 2024, the Company was named as a party to a complaint filed in Oakland County Court, Michigan by a former employee. The case was initially filed in the 6th Judicial District Circuit of Michigan. However, on February 15, 2024, the case was removed to the Federal Courts. The former employee is claiming breach of contract, unlawful termination and promissory estoppel. The Company has denied these claims.

There are no other material proceedings to which any director, officer, owner of record or beneficially of more than five percent of any class of voting securities, affiliate of the Company, or any associate of any such director, officer, security holder, or affiliate is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company of any of its subsidiaries.

BOARD AND COMMITTEE MEETINGS

Our Board of Directors held four meetings during the year ended December 31, 2023, which occurred on March 15, 2023, May 5, 2023, August 4, 2023, and November 10, 2023; and all directors attended 100% of the aggregate number of meetings of the Board and of the committees on which each of the directors served. The Board also acted by unanimous written consent six times since January 1, 2023.

COMMITTEES

Since April 22, 2022, our Board of Directors has a designated Compensation Committee, consisting of Steven Beabout and Ford Fay. Our Board of Directors has a designated Audit Committee, consisting of Sandy Shoemaker, Steve Beabout and Ford Fay. Our Board of Directors has a Nominating and Corporate Governance Committee, consisting of Ford Fay and Steve Beabout. We also have written charters for the Nominating and Corporate Governance, Compensation Committee and Audit Committee. The written charters can be found on our website at www.sobrsafe.com/corporate-policies/.

Audit Committee

The primary role of the Audit Committee is to assist with the financial oversight of the Company, which primarily includes the accounting, financial reporting, and audits of the financial statements of the Company.

The Nasdaq Capital Market rules require us to have, subject to certain exceptions, three independent Audit Committee members, with at least one member being an “audit committee financial expert”. Our Board of Directors has affirmatively determined that Sandy Shoemaker meets the definition of “independent director” and an “audit committee expert”, and Steven Beabout and Ford Fay qualify as “independent directors” for purposes of serving on an Audit Committee under Rule 10A-3 of the Securities Exchange Act of 1934, as amended, and Nasdaq Capital Market rules.

Our Audit Committee has held five meetings since January 1, 2023, which occurred on February 20, 2023, May 9, 2023, August 4, 2023, October 27, 2023, and March 28, 2024, and all members attended each meeting. The Audit Committee acted by unanimous written consent 0 times since January 1, 2023.

| 11 |

Compensation Committee

The primary role of the Compensation Committee is to oversee the Company’s overall executive compensation philosophy, policies and programs, and to determine, or recommend to the Board for determination, the compensation of the executive officers of the Company. Further discussion relating to the processes and procedures for the consideration and determination of executive compensation is described under Proposal 2 below.

The Nasdaq Capital Market rules require us to have two independent Compensation Committee members. Our Board of Directors has affirmatively determined that Steve Beabout and Ford Fay meets the definition of “independent director” for purposes of serving on a compensation committee under Rule 10A-3 of the Securities Exchange Act of 1934, as amended, and Nasdaq Capital Market rules.

Our Compensation Committee has held three meetings since January 1, 2023, which occurred on February 20, 2023, August 4, 2023 and October 27, 2023, and all members attended each meeting. The Compensation Committee acted by unanimous written consent 0 times since January 1, 2023.

Nominating and Corporate Governance Committee

The primary role of the Nominating and Corporate Governance Committee is to identify and recommend to the Board individuals qualified to become members of the Board (consistent with criteria the Board has approved). Further discussions of this process are described under “Director Nominations” above.

The Nasdaq Capital Market rules require us to have two independent Nominating and Corporate Governance Committee members. Our Board of Directors has affirmatively determined that Ford Fay and Steve Beabout meets the definition of “independent director” for purposes of serving on a Nominating and Corporate Governance Committee under Rule 10A-3 of the Securities Exchange Act of 1934, as amended, and Nasdaq Capital Market rules.

Our Nominating and Corporate Governance Committee held three meetings since January 1, 2023, which occurred on February 20, 2023, August 4, 2023 and October 27, 2023, and all members attended each meeting. The Compensation Committee acted by unanimous written consent 0 times since January 1, 2023.

Stockholder Communications

Stockholders who are interested in communicating directly with members of the Board of Directors may do so by writing directly to the individual Board members c/o Secretary, SOBR Safe, Inc., 6400 S. Fiddlers Green Cir., Suite 1400, Greenwood Village, Colorado 80111. The Company’s Secretary will forward communications directly to the appropriate Board member. If the correspondence is not addressed to the particular member, the communication will be forwarded to a Board member to bring to the attention of the Board. The Company’s Secretary will review all communications before forwarding them to the appropriate Board member.

Role of Board of Directors in Risk Oversight

While management is charged with the day-to-day management of risks that the Company faces, the Board of Directors and the Audit Committee are responsible for oversight of risk management. The full Board, and the Audit Committee since it was formed, have responsibility for general oversight of risks facing the Company. Specifically, the Audit Committee is tasked with periodically discussing policies with respect to risk assessment and risk management, and the Company’s plans to monitor, control and minimize such risks and exposures, with the independent public accounting firm, internal auditors and management.

Cybersecurity

We have a cross-departmental approach to addressing cybersecurity risk, including input from employees and our Board of Directors (the “Board”). The Board, Audit Committee, and senior management devote significant resources to cybersecurity and risk management processes to adapt to the changing cybersecurity landscape and respond to emerging threats in a timely and effective manner. Assessing, identifying, and managing cybersecurity related risks are integrated into our overall enterprise risk management (ERM) process. We have a set of Company-wide policies and procedures outlined in our Employee Handbook that directly or indirectly relate to cybersecurity risks. These policies go through an internal review process and are approved by appropriate members of management.

The Company’s EVP of Technology is responsible for developing and implementing our information security program and reporting on cybersecurity matters to the Board. Our EVP of Technology has over two decades of experience as a senior executive in technology-driven enterprises with expertise across cybersecurity, compliance, manufacturing process engineering, database architecture, interface programming and more.

The Company assesses the cybersecurity preparedness of third-party vendors by obtaining SOC 1 or SOC 2 reports. If a third-party vendor is not able to provide a SOC 1 or SOC 2 report, we take additional steps to assess their cybersecurity preparedness and assess our relationship on that basis. Our assessment of risks associated with the use of third-party providers is part of our overall cybersecurity risk management framework.

The Board and Audit Committee participates in discussions with management regarding cybersecurity risks and performs a review at least annually of the Company’s cybersecurity program. This includes discussions of management’s actions to identify and detect threats, as well as planned actions in the event of a response or recovery situation.

We are subject to cyber incidents and will continue to be exposed to cyber incidents in the normal course of our business. Although, such risks have not materially affected us, including our business strategy, financial condition, results of operations, or cash flows. The extensive approach we take to cybersecurity may not be successful in preventing or mitigating a cybersecurity incident that could have a material adverse effect on us. See Item 1A – Risk Factors in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 for a discussion of cybersecurity risks.

| 12 |

CODE OF ETHICS

On April 22, 2022, our Board of Directors adopted a code of business conduct and ethics applicable to our employees, directors and officers, in accordance with applicable U.S. federal securities laws and the corporate governance rules of Nasdaq. The code of business conduct and ethics is publicly available on our website at www.sobrsafe.com/corporate-policies/. Any substantive amendments or waivers of the code of business conduct and ethics or code of ethics for senior financial officers may be made only by our Board of Directors and will be promptly disclosed as required by applicable U.S. federal securities laws and the corporate governance rules of Nasdaq.

Additionally, we adopted a policy on insider trading which is publicly available on our website at www.sobrsafe.com/corporate-policies/. The Insider Trading Policy also specifically addresses hedging transactions, providing that any person wishing to enter into such an arrangement must first obtain written pre-clearance from the designated Compliance Officer. However, if any hedging transaction is considered a short-sale, it will be prohibited. In any event, no director or officer of SOBR Safe is permitted to purchase financial instruments, including, for greater certainty, prepaid variable forward contracts, equity swaps, collars, or units of exchange funds that are designed to hedge or offset a decrease in market value of any SOBR Safe securities granted as compensation or held, directly or indirectly, by such director or executive officer.

CLAWBACK POLICY

In accordance with the applicable rules of the Nasdaq Stock Market and Section 10D and Rule 10D-1 of the Securities Exchange Act of 1934, as amended, the Company has adopted a policy for the recovery of erroneously awarded incentive-based compensation from executive officers (a “Clawback Policy”). In the event of an Accounting Restatement, the Company will reasonably promptly recover erroneously awarded compensation received from executive officers in accordance with the Nasdaq Rules and Rule 10D-1.

SECTION 16(A) BENEFICIAL OWNERSHIP

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors, executive officers and persons who own more than ten percent of a registered class of the Company’s equity securities to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Officers, directors and greater than ten percent shareholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

DELINQUENT SECTION 16(A) REPORTS

During the most recent fiscal year, to the Company’s knowledge, the following delinquencies occurred:

| Name | No. of Late Reports | No. of Transactions Reported Late | No. of Failures to File |

| David Gandini | 0 | 0 | 0 |

| Jerry Wenzel | 0 | 0 | 0 |

| Ford Fay | 0 | 0 | 1 |

| Steven Beabout | 0 | 0 | 0 |

| Noreen Butler | 0 | 0 | 0 |

| Sandy Shoemaker | 0 | 0 | 0 |

| Gary Graham | 0 | 0 | 18 |

| 13 |

EXECUTIVE OFFICERS AND DIRECTORS; EXECUTIVE COMPENSATION

The following tables set forth certain information about compensation paid, earned or accrued for services by (i) the Company’s Chief Executive Officer and (ii) all other executive officers who earned in excess of $100,000 in the years ended December 31, 2023, 2022, and 2021 (“Named Executive Officers”):

| SUMMARY COMPENSATION TABLE | ||||||||||||||||||||||||||||||||||

| Name and Principal Position |

| Year |

| Salary ($)(1) |

|

| Bonus ($) |

|

| Stock Awards ($) |

|

| Option Awards ($) |

|

| Non-Equity Incentive Plan Compensation ($) |

|

| Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) |

|

| All Other Compensation ($) |

|

| Total ($) |

| ||||||||

| David Gandini, CEO and Secretary(2) |

| 2023 |

|

| 300,000 |

|

| -0- |

|

|

| 150,062 | (3) |

|

| 1,048,159 | (4) |

| -0- |

|

| -0- |

|

| -0- |

|

|

| 1,498,22 | (3,4) | ||||

|

|

| 2022 |

|

| 253,750 |

|

|

| 150,000 |

|

| -0- |

|

| -0- |

|

| -0- |

|

| -0- |

|

| -0- |

|

|

| 403,750 |

| |||||

|

|

| 2021 |

|

| 210,000 |

|

| -0- | (5) |

|

| 43,804 | (6) |

| -0- |

|

| -0- |

|

| -0- |

|

| -0- |

|

|

| 253,804 | (6) | |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

| Kevin Moore, Former CEO (7) |

| 2023 |

| -0- |

|

| -0- |

|

| -0- |

|

| -0- |

|

| -0- |

|

| -0- |

|

| -0- |

|

| -0- |

| ||||||||

|

|

| 2022 |

|

| 40,000 |

|

| -0- |

|

| -0- |

|

| -0- |

|

| -0- |

|

| -0- |

|

| -0- |

|

|

| 40,000 |

| ||||||

|

|

| 2021 |

|

| 185,500 |

|

| -0- | (8) |

|

| 43,804 | (9) |

| -0- |

|

| -0- |

|

| -0- |

|

| -0- |

|

|

| 229,304 | (9) | |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

| Jerry Wenzel, Former CFO(10) |

| 2023 |

|

| 225,000 |

|

| -0- |

|

|

| 24,000 | (11) |

| -0- |

|

| -0- |

|

| -0- |

|

| -0- |

|

|

| 249,000 | (11) | |||||

|

|

| 2022 |

|

| 185,417 |

|

| -0- |

|

|

| 287,750 | (12) |

|

| 409,611 |

|

| -0- |

|

| -0- |

|

| -0- |

|

|

| 882,778 | (12) | ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

| Scott Bennett, EVP of Bus Ops(13) |

| 2023 |

|

| N/A |

|

|

| N/A |

|

|

| N/A |

|

|

| N/A |

|

|

| N/A |

|

|

| N/A |

|

|

| N/A |

|

|

| N/A |

|

|

|

| 2022 |

|

| 175,000 |

|

| -0- |

|

|

| 108,500 | (14) |

| -0- |

|

| -0- |

|

| -0- |

|

| -0- |

|

|

| 283,500 | (14) | |||||

|

|

| 2021 |

|

| 89,167 |

|

| -0- |

|

|

| 45,532 | (15) |

|

| 540,706 |

|

| -0- |

|

| -0- |

|

| -0- |

|

|

| 675,405 | (15) | ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Michael Watson, Former EVP of Sales & Marketing(16) |

| 2023 |

|

| 158,333 |

|

| -0- |

|

| -0- |

|

| -0- |

|

| -0- |

|

| -0- |

|

| -0- |

|

|

| 158,333 |

| ||||||

|

|

| 2022 |

|

| 175,000 |

|

| -0- |

|

|

| 162,750 | (17) |

| -0- |

|

| -0- |

|

| -0- |

|

| -0- |

|

|

| 337,750 | (17) | |||||

|

|

| 2021 |

|

| 39,824 |

|

| -0- |

|

| -0- |

|

|

| 687,639 |

|

| -0- |

|

| -0- |

|

| -0- |

|

|

| 727,463 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dean Watson, Former CTO(18) |

| 2021 |

|

| 138,472 |

|

| -0- |

|

| -0- |

|

| -0- |

|

| -0- |

|

| -0- |

|

| -0- |

|

|

| 138,472 |

| ||||||

| (1) | Includes amounts paid and/or accrued. |

| (2) | Mr. Gandini was appointed as our Chief Executive Officer in October 2021. Mr. Gandini previously served as our Chief Revenue Officer and Chief Financial Officer. |

| (3) | Includes the value of 98,080 Restricted Stock Units under our 2019 Equity Incentive Plan based on the fair market value of our common stock on the date of the grant. |

| (4) | Includes the value of 510,000 stock options granted to acquire shares of our common stock under our 2019 Equity Incentive Plan. |

| (5) | Since Mr. Gandini received Restricted Stock Units in lieu of a cash bonus, his bonus amount is set forth under “Stock Awards” in the above table. |

| (6) | Includes 20,959 Restricted Stock Units under our 2019 Equity Incentive Plan, which were issued to Mr. Gandini in lieu of executive bonus he earned for 2020. The RSUs were valued based on the fair market value of our common stock on the date of grant. |

| (7) | Mr. Moore was appointed as our Chief Executive Officer on October 25, 2019, resigned as our Chief Executive Officer effective October 18, 2021, and continued employed in a strategic advisor position until October 31, 2022. |

| (8) | Since Mr. Moore received Restricted Stock Units in lieu of a cash bonus, his bonus amount is set forth under “Stock Awards” in the above table. |

| (9) | Includes 20,959 Restricted Stock Units under our 2019 Equity Incentive Plan, which were issued to Mr. Moore in lieu of executive bonus he earned for 2020. The RSUs were valued based on the fair market value of our common stock on the date of grant. |

| (10) | Mr. Wenzel was hired as our Chief Financial Officer in January 2022, resigned as our Chief Financial Officer effective December 31, 2023. |

| (11) | Includes the value of 50,000 Restricted Stock Units under our 2019 Equity Incentive Plan based on the fair market value of our common stock on the date of the grant. |

| (12) | Includes the value of 91,667 Restricted Stock Units under our 2019 Equity Incentive Plan based on the fair market value of our common stock on the date of grant. |

| (13) | Mr. Bennett was hired as our Executive Vice President of Business Operations in October 2021. Effective March 15, 2023, Scott Bennett will continue as Executive Vice President of Business Operations but will no longer be an officer of the Company. |

| (14) | Includes the value of 50,000 Restricted Stock Units under our 2019 Equity Incentive Plan based on fair market value of our common stock on the dates of grant. |

| (15) | Includes the value of 20,000 Restricted Stock Units under our 2019 Equity Incentive Plan based on fair market value of our common stock on the dates of grant. |

| (16) | Mr. Watson was hired as our Executive Vice President of Sales and Marketing in October 2021. Mr. Watson was terminated effective October 13, 2023. |

| (17) | Includes the value of 75,000 Restricted Stock Units under our 2019 Equity Incentive Plan based on fair market value of our common stock on the dates of grant. |

| (18) | Dean Watson was terminated effective August 20, 2021. |

| 14 |

PAY VS. PERFORMANCE

| Year |

| Summary Compensation Table Total for First PEO |

|

| Summary Compensation Table Total for Second PEO |

|

| Compensation Actually Paid to First PEO |

|

| Compensation Actually Paid to Second PEO |

|

| Average Summary Compensation Table Total for Non-PEO NEOs |

|

| Average Compensation Actually Paid to Non-PEO NEOs |

|

| Value of Initial Fixed $100 Investment Based on Total Stockholder Return |

|

| Net Income (Loss) |

| ||||||||

| 2023 |

| $ | 1,498,221 |

|

| $ | - |

|

| $ | 450,266 |

|

| $ | - |

|

| $ | 147,930 |

|

| $ | 170,644 |

|

| $ | 5 |

|

| $ | (10,214,721 | ) |

| 2022 |

| $ | 403,750 |

|

| $ | - |

|

| $ | 185,157 |

|

| $ | (826,873 | ) |

| $ | 386,007 |

|

| $ | (81,454 | ) |

| $ | 11 |

|

| $ | (12,354,930 | ) |

| 2021 |

| $ | 229,304 |

|

| $ | 96,304 |

|

| $ | 553,366 |

|

| $ | (1,860,184 | ) |

| $ | 424,710 |

|

| $ | 380,631 |

|

| $ | 101 |

|

| $ | (7,870,378 | ) |

During 2023, our Chief Executive Officer (PEO) was David Gandini. During 2022, our Chief Executive Officer (PEO) was David Gandini. During 2021, our Chief Executive Officers (PEOs) were Kevin Moore and David Gandini. David Gandini replaced Kevin Moore as PEO effective October 18, 2021. During 2023, our NEO’s consisted of Jerry Wenzel, Scott Bennett (through March 15, 2023), and Michael Watson (through October 13, 2023). During 2022, our NEOs consisted of Jerry Wenzel, Scott Bennett, and Michael Watson. During 2021, our NEOs consisted of David Gandini (through October 18, 2021), Scott Bennett, Michael Watson, and Dean Watson.

The following table sets forth the adjustments made to arrive at compensation “actually paid” to our PEOs during each of the years represented in the PVP Table:

| Adjustments to Determine Compensation “Actually Paid” to PEOs |

| 2023 |

|

| 2022 |

|

| 2021 |

| |||

| Deduction for amounts reported under the “Option Awards” column in the SCT |

| $ | (1,198,221 | ) |

| $ | - |

|

| $ | (43,804 | ) |

| Increase for fair value of awards granted during year that remain unvested at year end |

|

| 175,836 |

|

|

| - |

|

|

| 186,745 |

|

| Fair value of awards granted and vested in the same year |

|

| - |

|

|

| (161,175 | ) |

|

| (1,156,889 | ) |

| Change in fair value from prior year-end to current year-end of awards granted in prior years that were outstanding and unvested at year-end |

|

| - |

|

|

| - |

|

|

| - |

|

| Change in fair value from prior year-end to vesting date of awards granted in prior years that vested during year |

|

| - |

|

|

| (156,354 | ) |

|

| (796,064 | ) |

| Fair value of awards granted in prior years that failed to meet applicable vesting conditions |

|

| (25,570 | ) |

|

| (727,937 | ) |

|

| 177,586 |

|

| Total Adjustments |

| $ | (1,047,955 | ) |

| $ | (1,045,466 | ) |

| $ | (1,632,426 | ) |

| 15 |

The following table sets forth the adjustments made to arrive at the average compensation “actually paid” to our non-PEO NEOs during each of the years represented in the PVP Table:

| Adjustments to Determine Average Compensation “Actually Paid” to non-PEO NEOs |

| 2023 |

|

| 2022 |

|

| 2021 |

| |||

| Deduction for amounts reported under the “Option Awards” column in the SCT |

| $ | (24,000 | ) |

| $ | (968,611 | ) |

| $ | (1,350,285 | ) |

| Increase for fair value of awards granted during year that remain unvested at year end |

|

| - |

|

|

| (293,224 | ) |

|

| 1,023,191 |

|

| Fair value of awards granted and vested in the same year |

|

| (25,878 | ) |

|

| (489,139 | ) |

|

| - |

|

| Change in fair value from prior year-end to current year-end of awards granted in prior years that were outstanding and unvested at year-end |

|

| 24,000 |

|

|

| (36,512 | ) |

|

| 150,778 |

|

| Change in fair value from prior year-end to vesting date of awards granted in prior years that vested during year |

|

| 94,019 |

|

|

| (238,713 | ) |

|

| - |

|

| Fair value of awards granted in prior years that failed to meet applicable vesting conditions |

|

| - |

|

|

| (670,519 | ) |

|

| - |

|

| Total Adjustments |

| $ | 68,142 |

|

| $ | (2,696,719 | ) |

| $ | (176,316 | ) |

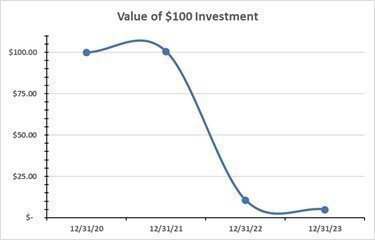

The following graph reflects the value of a fixed investment of $100 made on December 31, 2020:

Prior to the Company's up list to Nasdaq in May of 2022, the Company's stock was thinly traded on the OTC Pink and OTCQB markets. Due to a very limited float and a lack of investor awareness, SOBRsafe’s stock was not subject to an efficient trading market. In addition, there existed a substantial legacy shareholder base in the illiquid entities preceding SOBRsafe. Upon Nasdaq up list many of those shareholders chose to realize liquidity and exited the stock. The Company’s tradeable float is now approximately 12 million shares, and its post up list commitment to creating new investor awareness is reflected in the trading volume and shareholder count increases detailed below.

The following table compares the Company's stock, equity and cash as of and for the years ended December 31, 2020, 2021 and 2022:

|

|

| December 31, 2020 |

|

| December 31, 2021 |

|

| December 31, 2022 |

|

| December 31, 2023 |

| ||||

| Common Shares Outstanding |

|

| 8,640,678 |

|

|

| 8,778,555 |

|

|

| 16,972,241 |

|

|

| 18,582,241 |

|

| Annual Trading Volume of Shares |

|

| 52,365 |

|

|

| 77,662 |

|

|

| 334,819,866 |

|

|

| 101,588,190 |

|

| Approximate Shareholders of Record |

|

| 170 |

|

|

| 175 |

|

|

| 4,200 |

|

|

| 3,550 |

|

| Shareholders' Equity (Deficit) |

| $ | 3,039,484 |

|

| $ | (483,593 | ) |

| $ | 9,090,353 |

|

| $ | 1,982,537 |

|

| Cash |

| $ | 232,842 |

|

| $ | 882,268 |

|

| $ | 8,578,997 |

|

| $ | 2,790,147 |

|

| 16 |

Since 2019 the Company has been developing products leveraging proprietary transdermal (touch-based) technology to identify the presence of alcohol quickly and hygienically. During 2022 the Company raised $19.5M in support of the first product sales, continued product development, sales force deployment and its operational structure to support future sales growth.

As a result of the Company's transition in 2022 from a development stage level of operations to initial product sales, the PEOs’ and non-PEO NEOs’ level of compensation is consistent with the necessary experience required to raise capital, develop products, launch to customer markets and generate revenue. The comparison of the decline in investment value and losses incurred to the PEO and non-PEO NEO compensation are reflective of the Company moving from a limited shareholder base and trading volumes, and the required investments for product and market development to generate revenue.

Employment Contracts

David Gandini. On January 30, 2023, we entered into an Employment Agreement with Mr. Gandini to continue to serve as our Chief Executive Officer through December 31, 2025 (the “Term”). The Term will automatically renew for additional terms of one year unless written notice not to renew is otherwise given by either Mr. Gandini or the Company.

Under the terms of the Employment Agreement, Mr. Gandini will receive an annual base salary of $300,000. For each subsequent calendar year of the Term and Renewal Terms, Mr. Gandini will receive salary adjustments as recommended by the Compensation Committee and approved by the Company’s Board of Directors (the “Board”). Mr. Gandini is also entitled to participate in the Company’s Annual Bonus Plan and any and all other incentive payments available to executives of the Company. Mr. Gandini may also be provided with regular equity grants commensurate with his role and as awarded by the Board pursuant to the Company’s 2019 Equity Incentive Plan.