UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10‑K

x ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

OR

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from_____________ to _____________.

Commission file number 000-53316

| TRANSBIOTEC, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware |

| 26-0731818 |

| (State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

|

|

|

|

| 885 Arapahoe Road Boulder, CO |

| 80302 |

| (Address of principal executive offices) |

| (Zip Code) |

Registrant’s telephone number, including area code (303) 443-4430

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

| Name of each exchange on which registered |

| None |

| None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to and post such files). Yes ☐ No ☒

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S‑K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10‑K or any amendment to this Form 10‑K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

|

|

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

Aggregate market value of the voting and non-voting stock held by non-affiliates as of June 30, 2019: $504,722 as based on last reported sales price of such stock ($0.0046) on June 30, 2019. The voting stock held by non-affiliates on that date consisted of 109,722,144 shares of common stock.

Applicable Only to Registrants Involved in Bankruptcy Proceedings During the Preceding Five Years:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of April 10, 2020, there were 266,097,657 shares of common stock, $0.00001 par value, issued and outstanding.

Documents Incorporated by Reference

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to rule 424(b) or (c) of the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). None.

|

|

TransBiotec, Inc.

| 2 |

|

|

| Table of Contents |

Special Note Regarding Forward Looking Statements

This Annual Report includes forward‑looking statements within the meaning of the Securities Exchange Act of 1934 (the “Exchange Act”). These statements are based on management’s beliefs and assumptions, and on information currently available to management. Forward‑looking statements include the information concerning possible or assumed future results of operations of the Company set forth under the heading “Management’s Discussion and Analysis of Financial Condition or Plan of Operation.” Forward‑looking statements also include statements in which words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” “consider,” or similar expressions are used.

Forward‑looking statements are not guarantees of future performance. They involve risks, uncertainties, and assumptions. The Company’s future results and shareholder values may differ materially from those expressed in these forward‑looking statements. Readers are cautioned not to put undue reliance on any forward‑looking statements.

Corporate History

We were incorporated under the name Imagine Media, Ltd. on August 10, 2007. From inception through early 2009, our business was to publish and distribute Image Magazine, a monthly entertainment guide for the Denver, Colorado area. We generated only limited revenue and essentially abandoned our business plan in January 2009.

On September 19, 2011, we, Imagine Media, Ltd., a Delaware corporation, acquired approximately 52% of the outstanding shares of TransBiotec, Inc., (“TBT”) from TBT’s directors in exchange for 12,416,462 shares of our common stock. The accounting for this transaction was identical to that resulting from a reverse acquisition, except that no goodwill, or other intangibles were recorded, as the members of TransBioTec retained the majority of the outstanding common stock of Imagine Media LTD after the share exchange. These directors of TBT were Charles Bennington, Devadatt Mishal, Nicholas Limer, and Sam Satyanarayana. At the time, these shares represented approximately 52% of our outstanding common stock. TBT was a California corporation. In connection with this transaction, two of our officers resigned and Charles Bennington and Nicholas Limer were appointed as directors and as our President, Chief Executive Officer, and Chief Financial Officer, and our Secretary, respectively, and Ronald Williams was appointed as our Chief Technology Officer.

On January 17, 2012, our Board of Directors amended our Certificate of Incorporation changing our name from Imagine Media, Ltd. to TransBiotec, Inc. On January 31, 2012, we acquired approximately 45% of the remaining outstanding shares of TBT in exchange for 10,973,678 shares of our common stock. In connection with this transaction, two of our directors resigned and Sam Satyanarayana, Ronald Williams and Devadatt Mishal were appointed directors. Because of the September 2011 and January 2012 acquisitions of TBT common stock, we currently own approximately 98% of the outstanding shares of TBT, and we control its Board of Directors and officer positions. The remaining approximately 2% is owned by non-affiliated individuals that did not participate in the share exchange.

| 3 |

|

|

| Table of Contents |

Because of the acquisition, TBT’s business is our business and, unless otherwise indicated, any references to “us” or “we” include the business and operations of TBT. Due to our approximately 98% ownership of TBT, the approximately 2% non-controlling interest is combined with ours in the attached financial statements.

Our offices are located at 885 Arapahoe Road, Boulder, CO 80302, telephone number (303) 449-7235

Business Overview

General

We have developed an alcohol detection device called “SOBR”, for which we are still performing beta testing. The device is a patented system for use in detecting alcohol in a person’s system by measuring the ethanol content in their perspiration. Once SOBR is developed and tested, we plan to market the device to four primary business segments: (i) as an aftermarket-installed device to companies and institutions that employ or contract with vehicle drivers, such as trucking companies, limousine companies, and taxi cab companies, where the system will be marketed as a preventative drunk driving detection system, with a possible ignition locking device, (ii) the original equipment manufacturing (OEM) market, where the device would be installed in new vehicles during the original building of a vehicle, (iii) companies and institutions that have an interest in monitoring their employees’ or contractors’ alcohol level due to their job responsibilities, such as surgeons prior to entering surgery, pilots prior to flying aircraft, mineworkers prior to entering a mine, or the military for personnel returning to a military base from off-base leave or prior to leaving for a mission, and (iv) companies that would want to provide knowledge to their customers of their current alcohol level, such as lounge and bar owners, or customers attending a golfing event. We believe SOBR offers a unique solution to the national alcohol abuse problem.

We have developed a marketing plan that our management believes will gain market recognition for the SOBR device, primarily through trade shows, industry publications, general solicitation, social media, and public relations, as well as hopefully generating the demand for the SOBR device through the use of selling groups, such as channel sales, distributors, and independent sales contractors. We believe the primary market for the in-vehicle SOBR device initially is the commercial vehicle market, such as trucking companies, taxi cab companies, Uber, Lyft, limousine companies, and bus companies. Many of these companies have a significant financial interest in eliminating drunk drivers from their operations. Secondarily, individuals may desire to monitor a family member’s vehicle, such as an automobile operated by a minor or a family member with a past alcohol issue.

We believe the primarily market for the portable SOBR device is its use by companies and institutions that have an interest in monitoring their employees’ or contractors’ alcohol level due to their job responsibilities, such as surgeons prior to entering surgery, pilots prior to flying aircraft, mineworkers prior to entering a mine, or the military for personnel returning to a military base from off-base leave.

On May 6, 2019, we signed a definitive Asset Purchase Agreement (and signed an Amendment No. 1 dated March 9, 2020, together the “ APA “) with IDTEC, LLC (“IDTEC”), under which IDTEC agreed to provide personnel, experience, and access to funding to assist with the development of our SOBR device, as well as to sell to us certain robotics assets, which our management believes are synergistic with our current assets, in exchange for shares of our common stock equal to 60% of our outstanding common stock after giving effect to a reverse stock split to be effected in connection with closing the transaction. The APA is subject to several conditions precedent, primarily: (i) we must be current in our reporting requirements under the Securities Exchange Act of 1934, as amended, (ii) we must complete a reverse stock split of our common stock such that approximately 8,000,000 shares will be outstanding immediately prior to closing the transaction with no convertible instruments other than as set forth in the APA and our authorized common stock must be reduced to 100,000,000 shares, and (iii) we must not have more than approximately $150,000 in current liabilities. We do not believe we will close this transaction until Spring of 2020. At the time of the closing of the transaction we estimate we will have approximately 266,194,217 shares of our common stock outstanding before factoring in any reverse stock split.

| 4 |

|

|

| Table of Contents |

In advance of closing the transaction, IDTEC and a few other affiliated parties have been (i) loaning funds directly to us, (ii) spending funds for the general costs related to the transaction, and/or (iii) spending funds to further develop and enhance the current SOBR product. We are responsible for the funds loaned directly to us regardless if we close the transaction. However, if we do not close the transaction, we are not responsible for the funds spent that were related to the transaction (except those loaned directly to us) or funds spent to further develop the SOBR product. If we do close the transaction, all the funds spent by IDTEC and its affiliates for any reason related to the transaction will be turned into promissory notes at the closing of the APA and are expected to be around $1.5 million by the time we close the transaction.

The description of the APA set forth in this report is qualified in its entirety by reference to the full text of that document, and the amendment to the APA, which are attached as Exhibits 10._ and 10._, respectively, to this Annual Report on Form 10-K.

If the closing occurs, the assets being acquired under the APA are the same assets that were subject to the Letter of Intent with First Capital Holdings, LLC we previously announced our Current Report on Form 8-K filed with the Commission on November 6, 2018.

Principal Products and Services

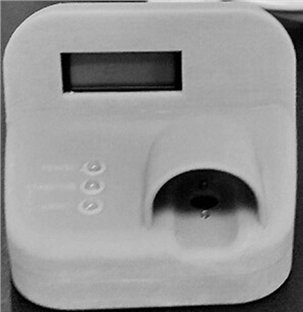

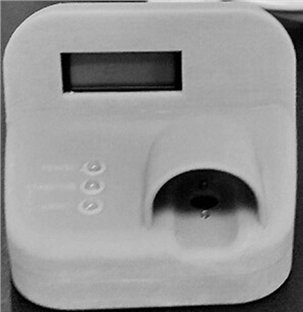

(photo of Updated SOBR sensor)

Our only product is SOBR. The SOBR device is a patented device for use in detecting alcohol in a person’s system by measuring the ethanol content in their perspiration and determining whether that level is over or under a preset level set by the installer or a trained technician. SOBR works by having an individual touch a sensor for approximately six seconds, the sensor is specific to ethanol. It detects ethanol secreted through sweat that emanates from the hands. The product is produced in two basic forms. The first is an in-vehicle system that can be connected to an interlock system to prevent the operation of the vehicle in the event the sensor detects measurable ethanol content. The second product is a portable unit that can be used anywhere.

| 5 |

|

|

| Table of Contents |

The in-vehicle unit can be in any machine, including automobiles, buses, trucks, boats and aircraft. Once the driver touches the sensor for approximately six seconds, the SOBR device detects ethanol secreted through sweat that emanates from the hands. If the vehicle is fitted with an interlock device, then the ethanol level is instantly translated into an engine “start” or “no-start” signal. SOBR can also initiate random real-time tests while the vehicle is operating to ensure that the operator’s ethanol level does not increase over the preset limit after the vehicle is started. If the system is tampered with while parked, the vehicle will not start. If the device is tampered with while driving, alarms will activate, such as the vehicle lights and horn, drawing attention to the vehicle. If a vehicle is equipped with a Global Positioning System, or Data Transmission Module, SOBR can alert fleet operators or others monitoring a vehicle of the detection of alcohol above preset levels.

When SOBR is installed in a vehicle, the system is virtually unnoticeable, unlike breathalyzer ignition interlock systems. SOBR requires approximately one hour to install in a vehicle. The control box can be mounted under the dash in the interior of the vehicle. In new vehicles the sensor can be installed as part of the steering wheel. In retrofits, the sensor is installed on the dashboard for easy access. We believe that our cost to manufacture a SOBR device will be approximately $100, and if the unit is installed in a vehicle the installation cost will be approximately $75. We estimate a per unit sales price range of $500 to $550, SOBR requires a semi-annual recalibration much like current smog devices. The recalibration is accomplished with a hand held device plugged into the control box and requires a trained technician approximately one hour to complete.

We plan to license the installation and recalibration rights to the automotive service industry.

The portable unit is similar in size and looks like a black, non-flip mobile telephone and can be temporarily attached to a solid fixture for more convenient usage. The portable unit can be used to test individuals before they are allowed to perform certain functions. As a portable unit the system will signal through the use of lights whether the tested individual is over a preset level. The company utilizing the device may then use the information how it sees fit.

Marketing

We have developed a marketing plan that our management believes will gain market recognition, as well as hopefully generate demand, for the SOBR device, primarily through trade shows, industry publications, general solicitation, social media, and public relations. We plan to sell the SOBR device through the use of selling groups, such as channel sales, distributors, and independent sales contractors. We believe the primary market for the in-vehicle SOBR device initially is the commercial vehicle market, such as trucking companies, taxi cab companies, limousine companies, and bus companies. Many of these companies have a significant financial interest in eliminating drunk drivers from their operations. Secondarily, individuals may desire to monitor a family member’s vehicle, such as an automobile operated by a minor or a family member with a past alcohol issue.

We believe the primary market for the portable SOBR device is its use by companies and institutions that have an interest in monitoring their employees’ or contractors’ alcohol level due to their job responsibilities, such as surgeons prior to entering surgery, pilots prior to flying aircraft, mineworkers prior to entering a mine, or the military for personnel returning to a military base from off-base leave.

| 6 |

|

|

| Table of Contents |

As a result, we initially plan to market SOBR to the voluntary, commercial market:

|

| o | commercial transportation companies that operate tractor trailers, taxis, construction vehicles, boats, trains, aircraft and other vehicles; |

|

| o | local, state and federal government agencies that operate fire trucks, police cars and public transportation systems; and |

|

| o | individuals that desire to monitor a family member’s vehicle, such as a vehicle operated by a minor. |

|

| o | a variety of government and military employees, such as sailors in the Navy who might be tested before boarding a ship after off-base leave. |

We plan to establish a distribution system of individuals and companies including value-added resellers (VARS), channel sales teams, and independent contractors, to sell the products to the market.

Manufacturing

We manufactured the prototype SOBR devices we have to date (approximately 10 devices) in-house from over-the-counter components. The primary part is the sensor, which is an over-the-counter sensor, which we program in-house with our proprietary programming to have the sensor perform the necessary functions in the SOBR device. Currently, we use one specific sensor from one manufacturer but we believe that we would be able to use other sensor in the event this manufacturer stopped selling the sensor we currently use.

Eventually, if we grow and need to mass manufacture the device, we are planning to manufacture of all components of the SOBR, as well as component assembly, through subcontracted to third parties and perform the final assembly, testing and calibration of the SOBR device at the company’s Colorado location. In order to assemble the SOBR device, a manufacturer only needs the space, manpower, and common, non-exotic equipment.

We are actively working with outside engineering firms for testing and validation. We are progressing and encouraged with the initial findings. We have ongoing discussions with a couple of industrial design firms to work with us on the final design for the launch of the product. We expect to complete our final internal testing in 2019 and move forward with the steps necessary to bring a much-needed product to market. We had research and development costs during the year ended December 31, 2019, which are included in general and administrative expenses in the attached financial statements.

Competition

Currently, to our knowledge, breath analyzer ignition interlocks are the only products on the market that can detect alcohol and lock the ignition system of a vehicle. There are several limitations inherent with current design of breath analyzers that can be circumvented and are invasive in their appearance and use. At present, their market is substantially made up of the mandated market (the legal market as a punitive testing device). If breath analyzer sales occur outside the mandated market, to our knowledge, that represents a much smaller sales number as percentage of business.

| 7 |

|

|

| Table of Contents |

We believe SOBR has the following advantages over the majority of traditional breath analyzers:

|

| o | Can be programmed to work during the entire operation of the vehicle without distracting the driver; |

|

| o | The system can be considered as non-invasive comparatively; |

|

| o | Easy retro fit installation; |

|

| o | Unobtrusive in the vehicle; |

|

| o | Difficult to circumvent; |

|

| o | Possible opportunity for the consumer to obtain insurance discounts that could offset some costs of the system. Although presently no insurance company is offering a premium discount, nor do we see that happening in the near future. |

To date the breath analyzer companies are predominantly focused on the mandated market and are not pursuing the commercial market with the same effort.

Intellectual Property

As a portable unit, the system will signal through the use of lights that the tested individual is over a preset level.

When SOBR is installed in a vehicle the system is less noticeable than the most common breathalyzer ignition interlock systems. SOBR requires approximately one hour to install in a vehicle. The control box can be mounted under the dash in the interior of the vehicle. In new vehicles, the sensor can be installed as part of the steering wheel as well as many other places in the vehicle that are convenient easily assessable to the driver. In retrofits, the sensor is installed on the dashboard for easy access. We believe that our cost to manufacture a SOBR device will be approximately $100, and if the unit is installed in a vehicle, the installation cost will be approximately $75. SOBR requires a semi-annual recalibration much like current smog devices. The recalibration is accomplished with a hand held device plugged into the control box and requires a trained technician approximately one hour to complete.

We plan to license the installation and recalibration rights to various retail and service businesses in the automotive service industry.

SOBR is protected by the following two patents, filed with the United States Patent and Trademark Office.

|

| 1. | Patent 6620108, which expires on December 26, 2021, pertains to the technology that identifies the vehicle’s operator. |

|

| 2. | Patent 9296298, which expires on December 9, 2034, pertains to an alcohol detection system for vehicle driver testing with integral temperature compensation. |

Since we have not generated revenue to date from any of the above patents, and we are still in the developmental stage, we expensed the patent costs; therefore, they are not recognized as intangible assets on the balance sheet.

Government Regulation

At the present time, only the judicially-mandated market is regulated. Devices sold into this market must be approved by state government agencies. Since we plan to enter this market last, we will not, initially, be subject to government regulation. However, we realize we would be subject to regulation if and when we were to enter the mandated market.

| 8 |

|

|

| Table of Contents |

Regarding the use in vehicles, we believe SOBR offers a unique solution to the national drunk driving problem and have been and are continuing to perform beta testing of SOBR for this use. Our objective is to grow our sales and manufacturing of SOBR by aggressively pursuing the original equipment market (“OEM”) once final beta testing is completed. We intend to seek an experienced OEM partner to introduce SOBR to the new automotive market. We believe that an increase in public awareness and consumer interest as well as potential cost savings will generate a demand for alcohol sensing technology. We hope that auto manufactures will begin installing SOBR as a factory installed option. If that happens, we expect it would occur for some time in the future. We will also market SOBR to international car manufacturers that may want to gain a market advantage over domestic auto manufacturers. We will seek to enter other markets as well, such as commercial trucking, as well as seek to have included in federal legislation a requirement that alcohol sensing devices with ignition locking systems be retrofitted in all vehicles in the U.S. France is one country that has created laws that mandate vehicles to have an alcohol detection device on all private vehicles.

Regarding the use in monitoring employees and contractors in certain industries, such as surgeons, pilots and the military, we are in the process of meeting with potential customers in certain identified business segments.

Currently, we do not have the money or funding to achieve the above goals and we will not be able to achieve our goals unless we are successful in obtaining funding through this offering and potentially future offerings as well, all which may serve to dilute the ownership position of our current and future shareholders.

Employees

As of December 31, 2019, we have two employees, namely Kevin Moore, our Chief Executive Officer, and David Gandini, our Chief Revenue Officer. Our President and Chief Financial Officers are independent contractors.

Available Information

We are a fully reporting issuer, subject to the Securities Exchange Act of 1934. Our Quarterly Reports, Annual Reports, and other filings can be obtained from the SEC’s Public Reference Room at 100 F Street, NE., Washington, DC 20549, on official business days during the hours of 10 a.m. to 3 p.m. You may also obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. The Commission maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Commission at http://www.sec.gov.

| 9 |

|

|

| Table of Contents |

As a smaller reporting company, we are not required to provide a statement of risk factors. However, we believe this information may be valuable to our shareholders for this filing. We reserve the right to not provide risk factors in our future filings. Our primary risk factors and other considerations include:

We have a limited operating history and historical financial information upon which you may evaluate our performance.

You should consider, among other factors, our prospects for success in light of the risks and uncertainties encountered by companies that, like us, are in their early stages of development. We may not successfully address these risks and uncertainties or successfully implement our existing and new products. If we fail to do so, it could materially harm our business and impair the value of our common stock. Even if we accomplish these objectives, we may not generate the positive cash flows or profits we anticipate in the future. We were incorporated in Delaware on August 10, 2007. Our business to date business focused on developing and improving our product, filing patents, and hiring management and staff personnel. Unanticipated problems, expenses and delays are frequently encountered in establishing a new business and developing new products. These include, but are not limited to, inadequate funding, lack of consumer acceptance, competition, product development, and inadequate sales and marketing. The failure by us to meet any of these conditions would have a materially adverse effect upon us and may force us to reduce or curtail operations. No assurance can be given that we can or will ever operate profitably.

We may not be able to meet our future capital needs.

To date, we have not generated any revenue and we have limited cash liquidity and capital resources. Our future capital requirements will depend on many factors, including our ability to develop our products, cash flow from operations, and competing market developments. We will need additional capital in the near future. Any equity financings will result in dilution to our then-existing stockholders. Sources of debt financing may result in high interest expense. Any financing, if available, may be on unfavorable terms. If adequate funds are not obtained, we will be required to reduce or curtail operations.

If we cannot obtain additional funding, our product development and commercialization efforts may be reduced or discontinued and we may not be able to continue operations.

We have historically experienced negative cash flows from operations since our inception and we expect the negative cash flows from operations to continue for the foreseeable future. Unless and until we are able to generate revenues, we expect such losses to continue for the foreseeable future. As discussed in our financial statements, there exists substantial doubt regarding our ability to continue as a going concern.

Product development efforts are highly dependent on the amount of cash and cash equivalents on hand combined with our ability to raise additional capital to support our future operations through one or more methods, including but not limited to, issuing additional equity or debt.

In addition, we may also raise additional capital through additional equity offerings, and licensing our future products in development. While we will continue to explore these potential opportunities, there can be no assurances that we will be successful in raising sufficient capital on terms acceptable to us, or at all, or that we will be successful in licensing our future products. Based on our current projections, we believe we have insufficient cash on hand to meet our obligations as they become due based on current assumptions. The uncertainties surrounding our future cash inflows have raised substantial doubt regarding our ability to continue as a going concern.

| 10 |

|

|

| Table of Contents |

Current economic conditions and capital markets are in a period of disruption and instability which could adversely affect our ability to access the capital markets, and thus adversely affect our business and liquidity.

The current economic conditions largely caused by the coronavirus pandemic have had, and likely will continue to have for the foreseeable future, a negative impact on our ability to access the capital markets, and thus have a negative impact on our business and liquidity. The recent, substantial losses in worldwide equity markets could lead to an extended worldwide recession. We may face significant challenges if conditions in the capital markets do not improve. Our ability to access the capital markets has been and continues to be severely restricted at a time when we need to access such markets, which could have a negative impact on our business plans. Even if we are able to raise capital, it may not be at a price or on terms that are favorable to us. We cannot predict the occurrence of future disruptions or how long the current conditions may continue.

The coronavirus pandemic is causing disruptions in the workplace, which will have negative repercussions on our business if they continue for an extended period time.

We are closely monitoring the coronavirus pandemic and the directives from federal and local authorities regarding not only our workforce, but how it impacts companies we work with for the development of our SOBR device. As more states and localities implement social distancing and “work from home” regulations more and more companies will be forced to either shut down, slow down or alter their work routines. Since the development and testing of our SOBR device is a “hands on” process these alternative work arrangements could significantly slow down our anticipated schedules for the development, marketing and leasing/sale of our SOBR device, which could have a negative impact our business.

Because we face intense competition, we may not be able to operate profitably in our markets.

The market for our product is highly competitive and is becoming more so, which could hinder our ability to successfully market our products. We may not have the resources, expertise or other competitive factors to compete successfully in the future. We expect to face additional competition from existing competitors and new market entrants in the future. Many of our competitors have greater name recognition and more established relationships in the industry than we do. As a result, these competitors may be able to:

|

| · | develop and expand their product offerings more rapidly; |

|

| · | adapt to new or emerging changes in customer requirements more quickly; |

|

| · | take advantage of acquisition and other opportunities more readily; and |

|

| · | devote greater resources to the marketing and sale of their products and adopt more aggressive pricing policies than we can. |

| 11 |

|

|

| Table of Contents |

If our products do not gain expected market acceptance, prospects for our sales revenue may be affected.

We intend to use the SOBR device in the commercial market, as opposed to the judicially-mandated market. Currently, most alcohol sensing devices are breath analyzers used in the judicially-mandated market where the use is usually required by law as a punishment for committing a crime. We will be asking commercial industries, auto manufacturers, companies that have commercial vehicles as their primary business (limousine companies, taxi cab companies, truck drivers, etc.), and companies and institutions that have an interest in monitoring their employees’ or contractors’ alcohol level due to their job responsibilities (such as surgeons, pilots, and the military), to adopt a new requirement that their employees or contractors must abide in order to remain employed. While we believe this will be attractive to many companies and industries, we must achieve some level of market acceptance to be successful. If we are unable to achieve market acceptance, our investors could lose their entire investment.

If critical components become unavailable or contract manufacturers delay their production, our business will be negatively impacted.

Currently, we manufacture the limited number of SOBR™ prototype devices we have developed by applying our proprietary know-how to “off the shelf” parts and components. However, if we are successful in our growth plan, eventually we will have to contract out our manufacturing of the devices. At that time, the stability of component supply will be crucial to determining our manufacturing process. Due to the fact we currently manufacture the device from “off the shelf” parts and components, all of our critical devices and components are supplied by certain third-party manufacturers, and we may be unable to acquire necessary amounts of key components at competitive prices.

If we are successful in our growth, outsourcing the production of certain parts and components would be one way to reduce manufacturing costs. We plan to select these particular manufacturers based on their ability to consistently produce these products according to our requirements in an effort to obtain the best quality product at the most cost effective price. However, the loss of all or one of these suppliers or delays in obtaining shipments would have an adverse effect on our operations until an alternative supplier could be found, if one may be located at all. If we get to that stage of growth, such loss of manufacturers could cause us to breach any contracts we have in place at that time and would likely cause us to lose sales.

If our contract manufacturers fail to meet our requirements for quality, quantity and timeliness, our business growth could be harmed.

We eventually plan to outsource the manufacturing of SOBR to contract manufacturers. These manufacturers will procure most of the raw materials for us and provide all necessary facilities and labor to manufacture our products. If these companies were to terminate their agreements with us without adequate notice, or fail to provide the required capacity and quality on a timely basis, we would be delayed in our ability or unable to process and deliver our products to our customers.

Our products could contain defects or they may be installed or operated incorrectly, which could reduce sales of those products or result in claims against us.

Although we have quality assurance practices to ensure good product quality, defects still may be found in the future in our future products.

End-users could lose their confidence in our products and Company when they unexpectedly use defective products or use our products improperly. This could result in loss of revenue, loss of profit margin, or loss of market share. Moreover, because our products may be employed in the automotive industry, if one of our products is a cause, or perceived to be the cause, of injury or death in a car accident, we would likely be subject to a claim. If we were found responsible, it could cause us to incur liability, which could interrupt or even cause us to terminate some or all of our operations.

| 12 |

|

|

| Table of Contents |

If we are unable to recruit and retain qualified personnel, our business could be harmed.

Our growth and success highly depend on qualified personnel. Competition in the industry could cause us difficulty in recruiting or retaining a sufficient number of qualified technical personnel, which could harm our ability to develop new products. If we are unable to attract and retain necessary key talents, it would harm our ability to develop competitive product and retain good customers and could adversely affect our business and operating results.

We may be unable to adequately protect our proprietary rights.

We currently have three “use” patents covering the SOBR device and one other pending with the USPTO. These are not patents over the components of the device, but instead covering the use of those components in the SOBR device. Our ability to compete partly depends on the superiority, uniqueness and value of our intellectual property. To protect our proprietary rights, we will rely on a combination of patent, copyright and trade secret laws, confidentiality agreements with our employees and third parties, and protective contractual provisions. Despite these efforts, any of the following occurrences may reduce the value of our intellectual property:

|

| · | Our applications for patents relating to our business may not be granted and, if granted, may be challenged or invalidated; |

|

| · | Issued patents may not provide us with any competitive advantages; |

|

| · | Our efforts to protect our intellectual property rights may not be effective in preventing misappropriation of our technology; |

|

| · | Our efforts may not prevent the development and design by others of products or technologies similar to or competitive with, or superior to those we develop; or |

|

| · | Another party may obtain a blocking patent and we would need to either obtain a license or design around the patent in order to continue to offer the contested feature or service in our products. |

We may become involved in lawsuits to protect or enforce our patents that would be expensive and time consuming.

In order to protect or enforce our patent rights, we may initiate patent litigation against third parties. In addition, we may become subject to interference or opposition proceedings conducted in patent and trademark offices to determine the priority and patentability of inventions. The defense of intellectual property rights, including patent rights through lawsuits, interference or opposition proceedings, and other legal and administrative proceedings, would be costly and divert our technical and management personnel from their normal responsibilities. An adverse determination of any litigation or defense proceedings could put our pending patent applications at risk of not being issued.

Furthermore, because of the substantial amount of discovery required in connection with intellectual property litigation, there is a risk that some of our confidential information could be compromised by disclosure during this type of litigation. For example, during the course of this kind of litigation, confidential information may be inadvertently disclosed in the form of documents or testimony in connection with discovery requests, depositions or trial testimony. This disclosure could have a material adverse effect on our business and our financial results.

| 13 |

|

|

| Table of Contents |

The internal controls we utilize to produce reliable financial reports have material weaknesses. If we continue to have material weaknesses in our internal controls, we may not be able to report our financial results accurately or timely or to detect fraud, which could have a material adverse effect on our business.

An effective internal control environment is necessary for us to produce reliable financial reports and is an important part of our effort to prevent financial fraud. We are required to periodically evaluate the effectiveness of the design and operation of our internal controls over financial reporting. Based on these evaluations, we have concluded in this report, as well as our prior reports, that we have material weaknesses in our internal controls and enhancements, modifications, and changes to our internal controls are necessary in order to eliminate these weaknesses. There are inherent limitations on the effectiveness of internal controls, including collusion, management override, and failure of human judgment. In addition, control procedures are designed to reduce rather than eliminate business risks. If we continue to fail to maintain an effective system of internal controls we may be unable to produce reliable, timely financial reports or prevent fraud, which could have a material adverse effect on our business, including subjecting us to sanctions or investigation by regulatory authorities, such as the Securities and Exchange Commission. Any such actions could result in an adverse reaction in the financial markets due to a loss of confidence in the reliability of our financial statements, which could cause the market price of our common stock to decline or limit our access to capital.

Our common stock has been thinly traded and we cannot predict the extent to which a trading market will develop.

Our common stock is quoted on the OTC Markets. Our common stock is thinly-traded compared to larger more widely known companies. Thinly traded common stock can be more volatile than common stock trading in an active public market. We cannot predict the extent to which an active public market for our common stock will develop or be sustained.

We may not be able to identify, negotiate, finance or close future acquisitions.

One component of our growth strategy focuses on acquiring additional companies or assets. We may not, however, be able to identify, audit, or acquire companies or assets on acceptable terms, if at all. Additionally, we may need to finance all or a portion of the purchase price for an acquisition by incurring indebtedness. There can be no assurance that we will be able to obtain financing on terms that are favorable, if at all, which will limit our ability to acquire additional companies or assets in the future. Failure to acquire additional companies or assets on acceptable terms, if at all, would have a material adverse effect on our ability to increase assets, revenues and net income and on the trading price of our common Stock.

We may acquire businesses without any apparent synergies with our current operations of alcohol detection devices.

In an effort to diversify our sources of revenue and profits, we may decide to acquire businesses without any apparent synergies with our current alcohol detection device operations. For example, we believe that the acquisition of technologies unrelated to alcohol detection devices may be an important way for us to enhance our stockholder value. Notwithstanding the critical importance of diversification, some members of the investment community and research analysts would prefer that micro-cap or small-cap companies restrict the scope of their activity to a single line of business, and may not be willing to make an investment in, or recommend an investment in, a micro-cap or small-cap company that undertakes multiple lines of business. This situation could materially adversely impact our company and the trading price of our stock.

| 14 |

|

|

| Table of Contents |

We may not be able to properly manage multiple businesses.

We may not be able to properly manage multiple businesses. Managing multiple businesses would be more complicated than managing a single line of business, and would require that we hire and manage executives with experience and expertise in different fields. We can provide no assurance that we will be able to do so successfully. A failure to properly manage multiple businesses could materially adversely affect our company and the trading price of our stock.

We may not be able to successfully integrate new acquisitions.

Even if we are able to acquire additional companies or assets, we may not be able to successfully integrate those companies or assets. For example, we may need to integrate widely dispersed operations with different corporate cultures, operating margins, competitive environments, computer systems, compensation schemes, business plans and growth potential requiring significant management time and attention. In addition, the successful integration of any companies we acquire will depend in large part on the retention of personnel critical to our combined business operations due to, for example, unique technical skills or management expertise. We may be unable to retain existing management, finance, engineering, sales, customer support, and operations personnel that are critical to the success of the integrated company, resulting in disruption of operations, loss of key information, expertise or know-how, unanticipated additional recruitment and training costs, and otherwise diminishing anticipated benefits of these acquisitions, including loss of revenue and profitability. Failure to successfully integrate acquired businesses could have a material adverse effect on our company and the trading price of our stock.

Our acquisitions of businesses may be extremely risky and we could lose all of our investments.

We may invest in other technology businesses or other risky industries. An investment in these companies may be extremely risky because, among other things, the companies we are likely to focus on: (1) typically have limited operating histories, narrower product lines and smaller market shares than larger businesses, which tend to render them more vulnerable to competitors’ actions and market conditions, as well as general economic downturns; (2) tend to be privately-owned and generally have little publicly available information and, as a result, we may not learn all of the material information we need to know regarding these businesses; (3) are more likely to depend on the management talents and efforts of a small group of people; and, as a result, the death, disability, resignation or termination of one or more of these people could have an adverse impact on the operations of any business that we may acquire; (4) may have less predictable operating results; (5) may from time to time be parties to litigation; (6) may be engaged in rapidly changing businesses with products subject to a substantial risk of obsolescence; and (7) may require substantial additional capital to support their operations, finance expansion or maintain their competitive position. Our failure to make acquisitions efficiently and profitably could have a material adverse effect on our business, results of operations, financial condition and the trading price of our stock.

Future acquisitions may fail to perform as expected.

Future acquisitions may fail to perform as expected. We may overestimate cash flow, underestimate costs, or fail to understand risks. This could materially adversely affect our company and the trading price of our Stock.

Competition may result in overpaying for acquisitions.

Other investors with significant capital may compete with us for attractive investment opportunities. These competitors may include publicly-traded companies, private equity firms, privately held buyers, individual investors, and other types of investors. Such competition may increase the price of acquisitions, or otherwise adversely affect the terms and conditions of acquisitions. This could materially adversely affect our company and the trading price of our stock.

| 15 |

|

|

| Table of Contents |

We may have insufficient resources to cover our operating expenses and the expenses of raising money and consummating acquisitions.

We have limited cash to cover our operating expenses and to cover the expenses incurred in connection with money raising and a business combination. It is possible that we could incur substantial costs in connection with money raising or a business combination. If we do not have sufficient proceeds available to cover our expenses, we may be forced to obtain additional financing, either from our management or third parties. We may not be able to obtain additional financing on acceptable terms, if at all, and neither our management nor any third party is obligated to provide any financing. This could have a negative impact on our company and our stock price.

The nature of our proposed future operations is speculative and will depend to a great extent on the businesses which we acquire.

While management typically intends to seek a merger or acquisition of privately held entities with established operating histories, there can be no assurance that we will be successful in locating an acquisition candidate meeting such criteria. In the event we complete a merger or acquisition transaction, of which there can be no assurance, our success if any will be dependent upon the operations, financial condition and management of the acquired company, and upon numerous other factors beyond our control. If the operations, financial condition or management of the acquired company were to be disrupted or otherwise negatively impacted following an acquisition, our company and our stock price would be negatively impacted.

We may make actions that will not require our stockholders’ approval.

The terms and conditions of any acquisition could require us to take actions that would not require stockholder approval. In order to acquire certain companies or assets, we may issue additional shares of common or preferred stock, borrow money or issue debt instruments including debt convertible into capital stock. Not all of these actions would require our stockholders’ approval even if these actions dilute our shareholders’ economic or voting interest.

Our investigation of potential acquisitions will be limited.

Our analysis of new business opportunities will be undertaken by or under the supervision of our executive officers and directors. Inasmuch as we will have limited funds available to search for business opportunities and ventures, we will not be able to expend significant funds on a complete and exhaustive investigation of such business or opportunity. We will, however, investigate, to the extent believed reasonable by our management, such potential business opportunities or ventures by conducting a so-called “due diligence investigation”. In a so-called “due diligence investigation”, we intend to obtain and review materials regarding the business opportunity. Typically such materials will include information regarding a target business’ products, services, contracts, management, ownership, and financial information. In addition, we intend to cause our officers or agents to meet personally with management and key personnel of target businesses, ask questions regarding the company’s prospects, tour facilities, and conduct other reasonable investigation of the target business to the extent of our limited financial resources and management and technical expertise. Any failure of our typical “due diligence investigation” to uncover issues and problems relating to potential acquisition candidates could materially adversely affect our company and the trading price of our stock.

| 16 |

|

|

| Table of Contents |

We will have only a limited ability to evaluate the directors and management of potential acquisitions.

We may make a determination that our current directors and officers should not remain, or should reduce their roles, following money raising or a business combination, based on an assessment of the experience and skill sets of new directors and officers and the management of target businesses. We cannot assure you that our assessment of these individuals will prove to be correct. This could have a negative impact on our company and our stock price.

We may be dependent on outside advisors to assist us.

In order to supplement the business experience of management, we may employ accountants, technical experts, appraisers, attorneys or other consultants or advisors. The selection of any such advisors will be made by management and without any control from shareholders. Additionally, it is anticipated that such persons may be engaged by us on an independent basis without a continuing fiduciary or other obligation to us.

We may be unable to protect or enforce the intellectual property rights of any target business that we acquire or the target business may become subject to claims of intellectual property infringement.

After completing a business combination, the procurement and protection of trademarks, copyrights, patents, domain names, and trade secrets may be critical to our success. We will likely rely on a combination of copyright, trademark, trade secret laws and contractual restrictions to protect any proprietary technology and rights that we may acquire. Despite our efforts to protect those proprietary technology and rights, we may not be able to prevent misappropriation of those proprietary rights or deter independent development of technologies that compete with the business we acquire. Litigation may be necessary in the future to enforce our intellectual property rights, to protect our trade secrets, or to determine the validity and scope of the proprietary rights of others. It is also possible that third parties may claim we have infringed their patent, trademark, copyright or other proprietary rights. Claims or litigation, with or without merit, could result in substantial costs and diversions of resources, either of which could have an adverse effect on our competitive position and business. Further, depending on the target business or businesses that we acquire, it is likely that we will have to protect trademarks, patents, and domain names in an increasing number of jurisdictions, a process that is expensive and may not be successful in every location. These factors could negatively impact our company and the trading price of our stock.

Integrating acquired businesses may divert our management’s attention away from our day-to-day operations and harm our business.

Acquisitions generally involve significant risks, including the risk of overvaluation of potential acquisitions and risks in regard to the assimilation of personnel, operations, products, services, technologies, and corporate culture of acquired companies. Dealing with these risks may place a significant burden on our management and other internal resources. This could materially adversely affect our business and the trading price of our stock.

We may fail to manage our growth effectively.

Future growth through acquisitions and organic expansion would place a significant strain on our managerial, operational, technical, training, systems and financial resources. We can give you no assurance that we will be able to manage our expanding operations properly or cost effectively. A failure to properly and cost-effectively manage our expansion could materially adversely affect our company and the trading price of our stock.

| 17 |

|

|

| Table of Contents |

The management of companies we acquire may lose their enthusiasm or entrepreneurship after the sale of their businesses.

We can give no assurance that the management of future companies we acquire will have the same level of enthusiasm for the operation of their businesses following their acquisition by us, or if they cease performing services for the acquired businesses that we will be able to install replacement management with the same skill sets and determination. There also is always a risk that management will attempt to reenter the market and possibly seek to recruit some of the former employees of the business, who may continue to be key employees of ours. This could materially adversely affect our business and the trading price of our Stock.

Because we are subject to the “penny stock” rules, the level of trading activity in our stock may be reduced.

Our common stock is traded on the OTC Markets. Broker-dealer practices in connection with transactions in “penny stocks” are regulated by certain penny stock rules adopted by the Securities and Exchange Commission. Penny stocks, like shares of our common stock, generally are equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on NASDAQ. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, broker-dealers who sell these securities to persons other than established customers and “accredited investors” must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. Consequently, these requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security subject to the penny stock rules, and investors in our common stock may find it difficult to sell their shares.

ITEM 1B – UNRESOLVED STAFF COMMENTS

None.

Our executive offices, consisting of approximately 250-500 square feet, are located at 885 Arapahoe Road, Boulder, Colorado 80302. We do not own our own manufacturing facility but plan to outsource with third party manufacturing companies for our manufacturing.

| 18 |

|

|

| Table of Contents |

On December 6, 2006, Orange County Valet and Security Patrol, Inc. filed a lawsuit against us in Orange County California State Superior Court for Breach of Contract in the amount of $11,164. A default judgment was taken against us in this matter. In mid-2013 we learned the Plaintiff’s perfected the judgment against us, but we have not heard from the Plaintiffs as of April 13, 2020.

We currently have one outstanding judgment against us involving a past employee of the Company. The matter is under the purview of the State of California, Franchise Tax Board, Industrial Health and Safety Collections. We currently owe approximately $28,786, plus accrued interest, to our ex-employee for unpaid wages under these Orders and are working to get this amount paid off.

In the ordinary course of business, we are from time to time involved in various pending or threatened legal actions. The litigation process is inherently uncertain and it is possible that the resolution of such matters might have a material adverse effect upon our financial condition and/or results of operations. However, in the opinion of our management, other than as set forth herein, matters currently pending or threatened against us are not expected to have a material adverse effect on our financial position or results of operations.

ITEM 4 – MINE SAFETY DISCLOSURES

Not Applicable.

| 19 |

|

|

| Table of Contents |

Market Information

Our common stock is currently quoted on the OTC Markets under the symbol “IMLE.” We were listed on March 18, 2009. The following table sets forth the high and low bid information for each quarter within the fiscal years ended December 31, 2019 and 2018, as best we could estimate from publicly-available information. The information reflects prices between dealers, and does not include retail markup, markdown, or commission, and may not represent actual transactions.

| Fiscal Year Ended |

|

|

| Bid Prices |

| |||||

| December 31, |

| Period |

| High |

|

| Low |

| ||

|

|

|

|

|

|

|

|

|

| ||

| 2018 |

| First Quarter |

| $ | 0.018 |

|

| $ | 0.0034 |

|

|

|

| Second Quarter |

| $ | 0.01 |

|

| $ | 0.004 |

|

|

|

| Third Quarter |

| $ | 0.01 |

|

| $ | 0.005 |

|

|

|

| Fourth Quarter |

| $ | 0.009 |

|

| $ | 0.0022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2019 |

| First Quarter |

| $ | 0.016 |

|

| $ | 0.0015 |

|

|

|

| Second Quarter |

| $ | 0.0095 |

|

| $ | 0.004 |

|

|

|

| Third Quarter |

| $ | 0.0325 |

|

| $ | 0.0042 |

|

|

|

| Fourth Quarter |

| $ | 0.085 |

|

| $ | 0.0072 |

|

The Securities Enforcement and Penny Stock Reform Act of 1990 requires additional disclosure relating to the market for penny stocks in connection with trades in any stock defined as a penny stock. The Commission has adopted regulations that generally define a penny stock to be any equity security that has a market price of less than $5.00 per share, subject to a few exceptions which we do not meet. Unless an exception is available, the regulations require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule explaining the penny stock market and the risks associated therewith. There are no limitations on dividends.

Holders

As of December 31, 2019, there were 214,626,540 shares of our common stock outstanding held by 161 holders of record and numerous shares held in brokerage accounts. Of these shares, 109,722,144 were held by non-affiliates. As of June 30, 2019, there were 109,722,144 shares held by non-affiliates, which we valued at $504,722, based on our closing share price of $0.0046 on June 30, 2019. As of April 10, 2020, there were 263,597,657 shares of our common stock outstanding held by 164 holders of record and numerous shares held in brokerage accounts.

Stock Options, Warrants and Convertible Debentures

On October 25, 2019, we granted Charles Bennington, one of our officers and directors, an option to acquire 800,000 shares of our common stock under our 2019 Equity Incentive Plan. The stock option has an exercise price of $0.00792 and vests quarterly over a one-year period commencing January 1, 2020. The stock option has a five-year term.

| 20 |

|

|

| Table of Contents |

On October 25, 2019, we granted Nick Noceti, our Chief Financial Officer, an option to acquire 800,000 shares of the Company’s common stock under our 2019 Equity Incentive Plan. The stock option has an exercise price of $0.00792 and vests quarterly over a two-year period commencing January 1, 2020. The stock option has a five-year term.

On October 25, 2019, we granted Gary Graham, one of our directors, an option to acquire 800,000 shares of our common stock under our 2019 Equity Incentive Plan. The stock option has an exercise price of $0.00792 and vests quarterly over a one-year period commencing January 1, 2020. The stock option has a five-year term.

On October 25, 2019, we entered into an Employment Agreement with Kevin Moore to serve as our Chief Executive Officer. Under the terms of the agreement, we granted an option to Kevin Moore under our 2019 Equity Compensation Plan to acquire 35,200,000 shares of our common stock at an exercise price of $0.00792, with the stock options to vest in 36 equal monthly installments of 977,777 shares during the three-year term of the employment agreement. A total of 1,955,555 options were vested as of December 31, 2019. None of the vested stock options have been exercised and no shares have been issued during the year ended December 31, 2019.

On October 25, 2019, we entered into an Employment Agreement with David Gandini to serve as our Chief Revenue Officer. Under the terms of the agreement, we granted David Gandini stock options under our 2019 Equity Compensation Plan to acquire 24,000,000 shares of our common stock, at an exercise price of $0.00792, to vest in 36 equal monthly installments of 666,666 shares during the three-year term of the Agreement. David Gandini was also granted an aggregate of 8,000,000 additional option shares (the “Pre-Vesting Option Shares”) to vest as follows: (i) 6,666,600 Pre-Vesting Option Shares representing the monthly vesting option shares for the ten months ended October 31, 2019 to vest on November 1, 2019; and (ii) the remaining 1,333,400 Pre-Vesting Option Shares representing the monthly vesting option shares for the two months ended December 31, 2019 shall vest on January 1, 2020. The stock options have a ten-year term. A total of 7,999,732 options were vested as of December 31, 2019. None of the vested stock options have been exercised and no shares have been issued during the year ended December 31, 2019.

On October 25, 2019, we granted stock options to four non-affiliated individuals and entities to acquire an aggregate of 6,400,000 shares of our common stock. The stock options were issued under the 2019 Equity Incentive Plan at an exercise price of $0.00792 vesting quarterly over a two-year period commencing January 1, 2020. The stock options have either a two year or five-year term.

On October 27, 2019, we entered into a patent purchase agreement under which the Company granted stock options to a non-affiliated party to acquire 3,200,000 shares of our common stock at an exercise price of $0.03125 and vested upon grant. The stock option has a five-year term. None of these stock options have been exercised and no shares have been issued during the year ended December 31, 2019.

During the year ended December 31, 2019, we granted options to purchase a total of 79,200,000 shares of our common stock, with 76,000,000 issued with an exercise price of $0.00792 per share under our 2019 Equity Incentive Plan and 3,200,000 issued with an exercise price of $0.03125 per share outside of any stock option plan.

As of December 31, 2018, there were three outstanding stock options to officers, directors, and consultants to purchase 1,775,000 shares of TransBiotec, Inc. common stock. These stock options vested upon grant and either expired or were cancelled in 2019.

| 21 |

|

|

| Table of Contents |

Dividends

There have been no cash dividends declared on our common stock and we do not anticipate paying cash dividends on our common stock in the foreseeable future. Common stock dividends are not limited and are declared at the sole discretion of our Board of Directors.

Our Series A-1 Convertible Preferred Stock earns cumulative dividends at a rate of 8% per annum, payable in cash or common stock at the option of the Company on June 30 and December 31 of each year. If paid in common stock, the common stock will be valued at the average of the closing price for the five business days prior to the dividend payment date. The Preferred shareholders will participate in any common stock dividends on an as converted basis. During the year ended December 31, 2019 and 2018, no dividends have been declared for holders of our 8% Series A-1 Convertible Preferred stock.

Securities Authorized for Issuance Under Equity Compensation Plans

On October 24, 2019, our 2019 Equity Incentive Plan went effective. The plan was approved by our Board of Directors and the holders of a majority of our voting stock on September 9, 2019. The plan’s number of authorized shares is 128,000,000. As of December 31, 2019, there were stock options granted to acquire 76,000,000 shares of common stock at an exercise price of $0.00792 per share under the plan. As of December 31, 2019, the plan had 14,755,287 vested shares and 61,244,713 non-vested shares. The stock options are held by our officers, directors and certain key consultants.

The table below provides information relating to our equity compensation plans as of December 31, 2019:

| Securities Plan Category |

| Number of Securities to Be Issued Upon Exercise of Outstanding Options |

|

| Compensation Plans Weighted-Average Exercise Price of Outstanding Options |

|

| Securities Remaining Available for Future Issuance Under Compensation Plans (Excluding those Reflected in First Column) |

| |||

| Equity compensation Plans approved by Securities holders |

|

| 14,755,287 |

|

| $ | 0.00792 |

|

|

| 61,244,713 |

|

Preferred Stock

On August 8, 2019, we entered into an 8% Series A-1 Convertible Preferred Stock Investment Agreement with First Capital Ventures, LLC (“FCV”), and its assignee. We desire to raise between $1,000,000 and $2,000,000 from the sale of our 8% Series A-1 Convertible Preferred Stock and FCV intends to raise between $1,000,000 and $2,000,000 (net after offering expenses) in a special purchase vehicle (“SPV”) created by FCV to purchase the 8% Series A-1 Convertible Preferred Stock. We granted FCV and its assigns, the exclusive right to purchase the 8% Series A-1 Convertible Preferred Stock. We agreed to pay $26,196 in legal and other expenses of the SPV subsequent to the day in which we receive a minimum of $1,000,000 from the sale of 1,000,000 shares of the 8% Series A-1 Convertible Preferred Stock. We also agreed to cancel all shares of our issued and outstanding Series A Preferred Stock, immediately following the closing date. Each Party shall pay their own expenses in connection with the Investment Agreement with FCV. We further agreed to issue FCV a three-year stock warrant to purchase 4,800,000 shares of our Common Stock at an exercise price of $ 0.03125 per share immediately following the closing date. We agreed to enter into a “business development” agreement with FCV, or its assignee, on the sale of the first $1,000,000 of 8% Series A-1 Convertible Preferred Stock and also granted FCV and its assigns, the right to use the name “SOBR SAFE” and any related intellectual property in connection with the SPV, and the offering of the Interests in the SPV. In accordance with the August 8, 2019, Investment Agreement with FCV, on December 9, 2019, our Board of Directors created a class of preferred stock designated as 8% Series A-1 Convertible Preferred Stock comprising of 2,000,000 shares. The rights and preferences of the 8% Series A-1 Convertible Preferred Stock are as follows: (a) dividend rights of 8% per annum based on the original issuance price of $1 per share, (b) liquidation preference over our common stock, (c) conversion rights into shares of our common stock at $1 per share (not to be affected by any reverse stock split in connection with the IDTEC APA), (d) redemption rights such that we have the right, upon thirty (30) days written notice, at any time after one year from the date of issuance, to redeem the all or part of the Series A-1 Preferred Stock for 150% of the original issuance price, (e) no call rights by us, and (f) each share of Series A Convertible Preferred stock will vote on an “as converted” basis. On December 12, 2019, we entered into a Series A-1 Preferred Stock Purchase Agreement (the “SPA”) with SOBR SAFE, LLC, a Delaware limited liability company and an entity controlled by Gary Graham, one of our Directors (“SOBR SAFE”), under which SOBR SAFE agreed to acquire One Million (1,000,000) shares of our Series A-1 Convertible Preferred Stock (the “Preferred Shares”), in exchange for One Million Dollars ($1,000,000) (the “Purchase Price”). We received the Purchase Price on December 12, 2019. In connection with the closing of the SPA, holders of our common stock representing approximately 52% of our then-outstanding common stock and voting rights signed irrevocable proxies to Gary Graham and/or Paul Spieker for the purpose of allowing Mr. Graham and/or Mr. Spieker to vote those shares on any matters necessary to close the transaction that is the subject of the certain Asset Purchase Agreement May 6, 2019, as amended.

| 22 |

|

|

| Table of Contents |

Our Series A-1 Convertible Preferred Stock earns cumulative dividends at a rate of 8% per annum, payable in cash or common stock at the option of the Company on June 30 and December 31 of each year. If paid in common stock, the common stock will be valued at the average of the closing price for the five business days prior to the dividend payment date. The Preferred shareholders will participate in any common stock dividends on an as converted basis. As of December 31, 2019 and December 31, 2018, the Company had no issued shares of its 8% Series A-1 Convertible Preferred stock, respectively. During the years ended December 31, 2019 and 2018, no dividends have been declared for holders of the 8% Series A-1 Convertible Preferred stock.